Market Feels Tired. Raise Stops and Lock In Profits. Trading Volume Is Light

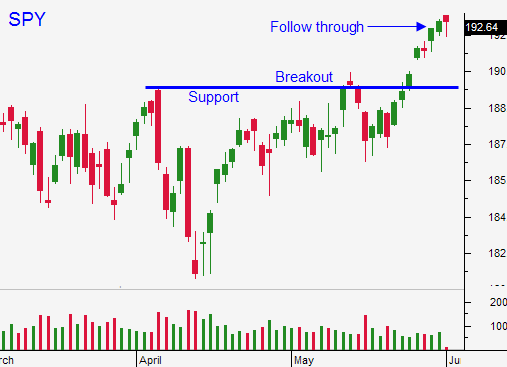

Posted 10:00 AM ET - Since the breakout to new all-time highs a few weeks ago, the market has been pushing higher each day. The momentum is slowing down and we are seeing some profit-taking this morning.

There is no news to justify the decline this morning. By the same token, I can't justify the recent rally.

Trading volumes are extremely light and a small bid can push stocks higher. Money is dripping into equities because of a lack of attractive investment alternatives.

At a forward P/E of 16, stocks are not cheap. Revenue growth is barely keeping pace with inflation and profit growth is flat. Corporate guidance for Q2 has been cautious.

Bond yields are near historic lows. Surprisingly, Spanish bond yields are on par with US Treasuries. Spain has massive debt, fiscal deficits and a 25% unemployment rate. Global credit markets are intertwined.

If Spain (or any EU member) defaults, the ECB will do everything in its power to bail them out. If the EU fails, the whole world fails. Central banks around the globe know that the first domino cannot fall. This is why Spanish debt is trading on par with US debt.

Investors are being pushed out on the risk curve.

This bubble can continue to grow and it is foolish to pick a top. Know that it exists and keep an eye on PIIGS bond yields.

The news is very light and there is nothing to drive the price action.

I am day trading - no overnight positions.

If we get a pullback to SPY $190, I will sell out of the money put credit spreads. That support should hold.

If you own calls, take profits if the SPY closes below $195. The market feels tired - don't let your profits slip away.

.

.

Daily Bulletin Continues...