Major News On Wed – FOMC Won’t Add Anything New – Job Growth Could Push Rates Higher

Posted 11:00 AM ET - This is a news filled week and the market could experience some jitters as it treads water near the all-time high. Tomorrow’s releases are very important.

GDP will be released before the open. Analysts are expecting a 2.9% increase for Q2. That comes on the heels of a 2.9% decline in Q1. I doubt that the economy will be able to make a 6% jump from Q1 to Q2.

ADP will also be released before the open. The consensus estimate is 215,000 new private sector jobs in July. That is on par with last month’s expectations, but ADP spiked to 288,000 in June. Initial jobless claims have been declining and I believe we could see a number north of 250,000.

Tomorrow afternoon, the FOMC will release its statement. They will go on recess and the next meeting is on September 16th. They don't want to spook the market and I believe the rhetoric will be dovish. The market typically does not trade well when they are in recess.

Strong economic data is likely to put upward pressure on interest rates. We could be entering a phase where "good news is bad news", but I am not expecting this headwind until September.

More than half of the S&P 500 companies have reported. Revenues are up 5% and earnings are up 8%. This is stellar performance.

Asset Managers did not participate in the light volume rally that started in May. Now that they have proof that a job recovery is underway, they are playing catch-up. The bid to the market is strong.

We are likely to see some nervous jitters this week. The Fed will not change the rhetoric and buyers will return in a few days.

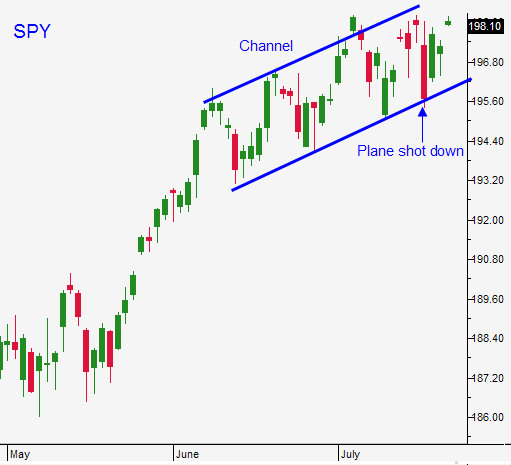

I still believe the market has some upside, but I won't buy until we have a dip. If the SPY pulls back to $196 this week, I will buy calls. The uptrend from April needs to be preserved in order for me to take bullish positions.

If we don't get the pullback, I will wait patiently on the sidelines.

With all of the news coming out tomorrow, I suggest staying in cash.

Look for choppy trading today.

.

.

Daily Bulletin Continues...