Market Needs ECB Action and Good Flash PMIs – Then Earnings Will Spark Buying

Posted 11:00 AM ET - WEBINAR TONIGHT - Lowest price of the year. I will show you how easy it is to find trades using my system.

OPTIONS TRADING WEBINAR REGISTRATION

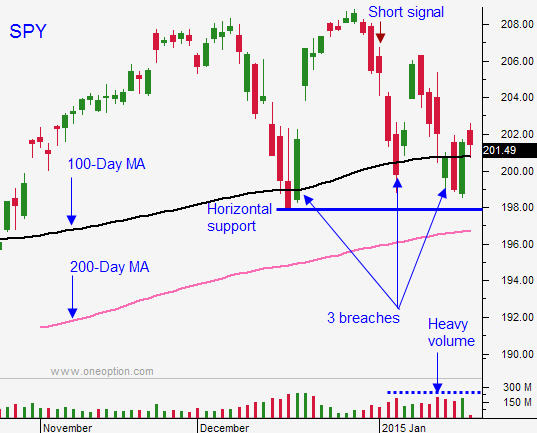

Yesterday, the market showed some resilience. The S&P 500 fell below the 100-day moving average and buyers stepped in. The technicals this year have been weak and this was a step in the right direction.

The expectations for tomorrow's ECB meeting are high. Traders are expecting a €700 billion package and Draghi had better deliver. If he doesn't, the selling pressure in Europe will be heavy.

Friday morning, flash PMI's will be released. All eyes will be on China. Their market tanked 7.7% on Monday after posting GDP, IP and retail sales. Their economic activity has gradually been trending lower and it will be difficult for them to maintain a 7.3% growth rate. China’s market rebounded and it is only down 1.5% for the week. Traders are expecting the PBOC to take action.

If these two macro events are in line, we have a chance for a nice earnings rally. Intel was strong last week and IBM was better than feared yesterday. Netflix beat estimates and it is up 16% this morning. SanDisk and Xilinx will report after the close and they will set the tone for tech stocks. American Express will announce after the close and it will give us some insight on consumer spending.

The selling pressure last few weeks has been heavy and technical damage has been done. Consequently, I am not going to get overly aggressive playing this bounce. I will use a neutral to slightly bullish options strategy.

I will be selling out of the money bullish put spreads on retail/restaurant stocks that announce in a few weeks. I believe lower gasoline prices will help these groups. If you are not familiar with this options trading strategy, you should learn it.

I will be selling put options below technical support and I will buy farther out options to limit my risk and to lower my margin requirement. If technical support is breached, I will buy the options spreads back. This options trading strategy allows me to distance myself from the action and I can take advantage of time decay. If the market declines, I will short S&P futures below the 100-day moving average and I will use SPY $200.90 as my stop.

Will also day trade from the long side today if the market can make a new high after the first hour of trading. I will use that high price as my stop.

I'm a little more concerned that Draghi will underdeliver tomorrow. He has been providing lipservice for the last two years and we will see if he can pull the trigger.

Asset Managers are not very aggressive and they don't seem worried about missing the next big move. Support has been difficult to establish and it has taken longer than normal. We are seeing heavy volume declines and light volume rallies. The character of the market has changed and we could be in for more volatility in coming months.

Central bank easing is nothing more than a sugar high. Traders are realizing that QE is not stimulating economic growth.

If the market fails to bounce and the SPY falls closes below the 100-day moving average, it will quickly challenge the 200-day moving average. A lower high could be a sign that the market is topping.

I am short term bullish and I believe this support level will hold.

You can tell from my comments, that I am playing it safe. I will sell out of the money put options and I will hedge using the S&P futures if the 100-Day MA is breached.

Be careful the next two days

.

.

Daily Bulletin Continues...