Market Is Weakening – Earnings Need To Attract Buyers – Strongest Companies On Deck

Posted 10:30 AM ET - I will be hosting my biggest webinar of the year on Wed. I will describe my Deal of the Year and we will look for new trades.

OPTIONS TRADING WEBINAR - REGISTER

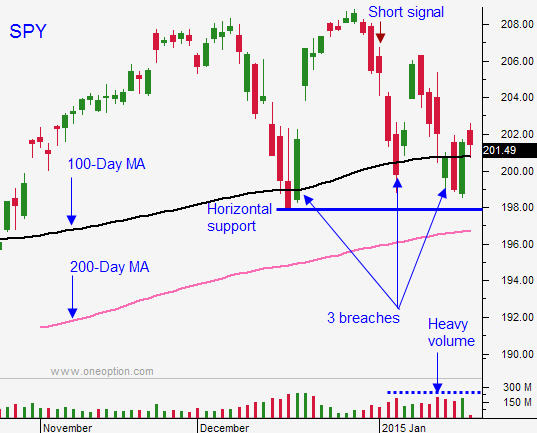

Last week, the market took a tumble and it fell below the 100-day moving average. This is the third breach in the last month and it is a bearish sign. We've seen light volume rallies and heavy volume declines in the last three months and the selling pressure is building. Earnings season is underway and if profits fail to attract buyers, we could be in for a nasty slide.

Intel posted better-than-expected results last Thursday and it helped the market rally above the 100-day moving average on Friday.

If the 100-Day MA is breached today, I will short the S&P futures and I will use SPY $200.80 as my stop. I am not taking any overnight positions yet. I want to see the earnings reaction over the next few days. I will also day trade from the long side if the market is above the high price set during the first hour of trading. That will be my entry and my stop.

China posted GDP, industrial production and retail sales. The numbers were in line with expectations, but GDP is in a sequential down trend. China's stock market was down 7.7% yesterday and this is one of the worst declines in years. They are the largest economy in the world and it will be difficult for them to maintain a 7.3% growth rate. The flash PMI's on Friday will be extremely important.

Many believe that the PBOC will ease and that is why Chinese stocks rebounded 1.7% this morning.

Europe has been weak for years. This Thursday, the ECB is expected to ease. Draghi has been providing lipservice for years. If he disappoints again, European markets will plunge.

In reality, central bank easing has been nothing more than a sugar high. Japan has thrown the kitchen sink at their economy and QE has not stimulated growth.

We don't know the impact of lower oil prices on earnings. Energy companies will be hurt and we need to see an uptick in consumer spending to balance the ledger.

I typically like to sell out of the money put spreads after earnings announcements. I look for companies that beat on the top line and the bottom line. Then I look for technical support and I sell the strike price that is below that support level. Option implied volatilities are still relatively high in the first hour of trading and I try to capitalize on that. If technical support is breached, I buy back my put options. I won't be selling any bullish put spreads until I see support build at the 100-Day MA. I also need to see a few more days of decent earnings.

Morgan Stanley had write-downs and they missed their number. Netflix and IBM will announce after the close today. Netflix tanked after their number last quarter and IBM has been disappointing for more than a year. As the week progresses, the quality of earnings releases will improve.

Ideally, earnings will be decent, the ECB will ease and the flash PMI's on Friday will be in line. If we get all of these, we should see a nice rally that can last a couple of weeks. We need convincing news on all three fronts.

If the market falls below the 100-day moving average, we will quickly test the 200-Day MA.

The strongest companies announce early in the earnings cycle and I believe we will get the bounce. If the bounce only lasts a few days and it stalls below SPY $206, we are headed for trouble. If the bounce lasts a few weeks and it challenges the high, we could be in good shape for the next couple of months.

As the week unfolds, I will be able to gauge the price action. Today I am just day trading.

.

.

Daily Bulletin Continues...