Best Options Trading Strategy Is To Buy Calls – Look For These Stock Patterns

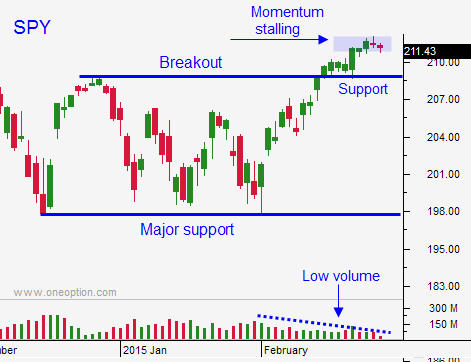

Today's Options Trading Strategy - I am buying call options on stocks that are breaking out. Look for stocks that have consolidated in a tight range for a few weeks (or longer) and are breaking through horizontal resistance. These breakouts lead to sustained rallies. When the momentum stalls, take profits and look for the next opportunity. This is a relatively high probability trading environment and buying options is the way to go. You have a small market tailwind working in your favor and you will get your biggest bang for your buck buying call options. This is my primary options trading strategy right now.

From a day trading standpoint, I am more interested in buying dips than I am buying breakouts. I have plenty of long exposure because of my call positions so I don't need to chase rallies.

Posted 11:00 AM ET - Yesterday the market showed a few signs of strain late in the day. The NASDAQ composite rollover and Apple was the primary culprit. If not for Apple, the NASDAQ 100 would only be up .8% this year.

Apple is weak today, but other tech stocks are carrying load. This type rotation is healthy.

"Yellen speak" was generally positive and even though the word "patient" might be removed in the March FOMC statement, the likelihood of tightening before June is slim. The Fed knows that a strong dollar will hurt exports.

Greece has its loan extension and it won't be a concern for at least a month. We can expect the rhetoric to get nasty after that.

China's flash PMIs were better than expected. Retail sales were light, but traders are expecting action by the PBOC.

Durable goods orders were slightly better-than-expected this morning (2.8%). If you strip out transportation, it was only up .8%.

The path of least resistance is up. I don't see any speed bumps and it should be clear sailing the rest of the week.

Look for positive price action the rest of the week.

.

.

Daily Bulletin Continues...