Market Breakout Was A Head Fake – Bullish Speculators Are About to Get Flushed Out

Posted 9:40 AM ET - The one-day rally to new highs did not last. Stocks retreated yesterday and they gave back all of the gains from Monday. I suspected this could happen and that's why I took profits on my call positions last Friday.

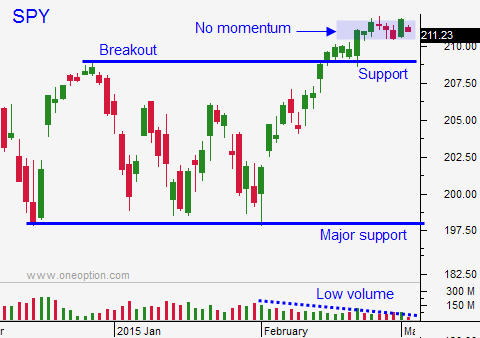

The price action has been lackluster. The Dow Jones and S&P 500 barely established new all-time highs before stalling out. Trading ranges are compressed and the market can't rally on good news (Greece, ECB, FOMC minutes and the PBOC rate cut). Bullish sentiment is very high and speculators need to get flushed out.

China lowered commercial lending rates by .5% overnight and India had a surprise rate cut. In both cases, their markets were down. Central bank money printing has lost its punch and monetary stimulus is not increasing economic activity.

ADP reported that 212,000 new jobs were created in the private sector during the month of February. The government's number has been outpacing ADP. If Friday's jobs report is greater than 250,000, tightening fears will increase and we will see a round of profit-taking.

Fed officials are worried about a market "disconnect". They don't believe that equities are pricing in the likelihood of a rate hike. This tells me that it might happen in June (not many analysts are expecting this). The wage component in Friday's jobs report will be scrutinized. Minimum wages are going up and this is the largest input cost for companies. Higher wages take a bite out of profits and they typically lead to inflation. That is why we are seeing a bond selloff.

We started to see late day selling last week and that was the first warning sign. The NASDAQ 100 is up 4.8% this year, but if you strip out Apple, it is only up .8%. Once stock is accounted for most of the move. Apple peaked and it looks tired so this catalyst is run its course.

We've seen a pattern in the last six months where the market tests the 100-day moving average and it rallies to a new all-time high. The difference between the new high and the prior high is very small. Once the momentum stalls, the market rolls over and we test the 100-day moving average again. The recent price action suggests that this pattern might repeat itself.

Stocks are trading lower this morning. The ADP report did not have much of an impact and ISM services/the Beige Book will not have much of an impact during trading.

I predicted that we would see a decline this week and we got one. Now we need to see if there is follow-through selling. First support is SPY $209. If that level holds and we bounce immediately, we could take out the high. This would indicate that the bid is strong and that the market is ready to run. As much as I'd like to see it, this scenario is unlikely. If the market tests SPY $209 and we fall below it, the 100-day moving average will be challenged. Bullish speculators will bail out of positions and we could hit an air pocket on the way down. I see this as a more likely trading scenario.

When the market failed to rally after the breakout, my bias turned from bullish to neutral. Now that I've seen late day selling and an inability to move higher on good news, my bias is turned a little more bearish.

I will be day trading from the short side today if we make a new low after the first hour. I won't be taking overnight positions until I see how this plays out. Once I get a feel for the price action, I can start to take directional (overnight) trades.

Look for weak price action today.

.

.

Daily Bulletin Continues...