Look For A Few Days of Weakness – Wait For Support – Sell Bull Put Spreads

Take the FREE TRIAL and view every trade signal for every stock. Make sure to check your stocks first.

Posted 10:00 AM ET - The market was closed Friday when the Unemployment Report was released. Analysts were expecting 245,000 new jobs in March and only 126,000 new jobs were created. Furthermore, the February employment number was reduced by 30,000. This was a big miss and the S&P 500 traded 20 points lower on the news.

I hate to say I told you so - but I told you so. When the February number came out I knew was a complete farce. It was contrary to every other employment report and economic release. Traders have been worried about a tiny little .25% rate hike when the bigger concern should be economic growth.

The market is finding some support this morning and the S&P 500 has recouped some of its losses. ISM services will be released 30 minutes after the open and I believe the number will be a little light. This should spark an additional wave of selling.

The FOMC minutes will be released Wednesday. The comments should be a little more hawkish than most people would like, but they will be discounted because of Friday's jobs report. The Fed will remain dovish and we won't see a rate hike in June.

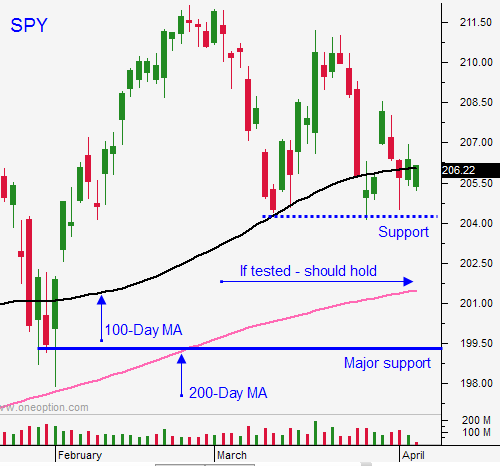

It is hard to predict wiggles and jiggles, but I believe we will see some selling early this week. I will day trade from the short side today if the SPY falls back below $206 and I will use that as my stop. If the market closes on its low of the day, I will buy a few puts with the notion that we will test the SPY $201.

I don't think this wave of selling will be very heavy. The market has been chopping around in this range and earnings season should attract buyers. I don't feel the panic this morning and if we do test the 200-day moving average, it will be brief.

I am looking for opportunities to sell out of the money put credit spreads on strong stocks (bullish put spreads). I feel that we should see a nice little earnings bounce for the next couple of weeks.

Towards the end of April, we could run into trouble. Economic conditions in Asia are deteriorating and earnings guidance will be cautious.

In summary, I am looking for weakness for the next few days and an earnings bounce.

If you are a nimble, try to play the short side for a few days and use SPY $206 as your guide. If you are a swing trader, let this wave of selling pass and sell April bull put spreads into earnings season once support is established.

.

.

Daily Bulletin Continues...