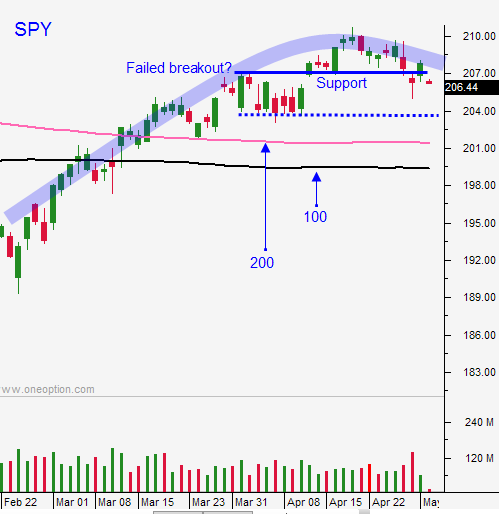

Buy Puts When the SPY Trades Below $204 – This Could Get Ugly

TAKE THE FREE TRIAL AND GET THE PLAY BY PLAY IN THE CHAT ROOM TODAY

Posted 9:45 AM ET - This week the market has been opening on the high and closing on the low. That is a bearish pattern and we are likely to see it again today. In April 160,000 new jobs were created and that is below estimates. The SPY is below $204 and that is a significant support level.

Some traders will see this as bullish news. Slow employment growth will give the Fed more breathing room and that pushes back the timetable for the next rate hike. Once the dust settles, that notion will start to wane. A soft patch would be bad for the economy and stocks will drift lower.

The rally the last two months has been manufactured by central bank money printing. That stimulus has run its course and the rhetoric is getting more hawkish. This will weigh on the market.

Earnings season is winding down and the results are not that impressive. Mega cap tech stocks typically lead the charge and most of them retreated after posting results. The QQQ has broken major support levels this week and it looks like the S&P will follow suit.

The price action today will be determined in the first hour of trading. Sellers will unload stocks and the downside will be tested. If the decline is very shallow and stocks rally, I will focus on shorts. I will be aggressive shorting around the $204 level and I will use it as a stop. This will be an excellent opportunity to take bearish positions and the low of the day will be breached with ease. After that, we could drift lower the rest of the day.

If the market hits an air pocket in the first hour and the S&P drops 20 points or more, I will play the bounce and I will find stocks with relative strength. Once that bounce runs out of steam, the market will roll over and challenge support one more time. If we make a new low for the day, we will drift lower into the close and this could be a nasty round of selling.

Either way, the news today will prompt profit-taking.

The market has horizontal support at $204 and that is the 50-day moving average. Once it is breached, the next support level is $202 and we have major support at $200.

I am forecasting a drop to SPY $200 in the next few weeks. The only question is how quickly we get there.

If you want the play-by-play today, sign up for the free trial and watch us trade in the chat room. There'll be excellent opportunities today.

If I had my druthers, I want to see an early rally this morning. I will scramble to find shorts and I will start scaling in once I see resistance.

.

.

Daily Bulletin Continues...