Market Will Nurse A Holiday Hangover Today – Path Of Least Resistance Is Up

Posted 9:40 AM ET - The market is going to nurse a holiday hangover today. Many traders will take extra time off and the volume will be light. ADP will give us a peek at job growth tomorrow and the volume should pick up.

Credit concerns remain low and that bodes well for equities. Interest rates are at historic lows and stocks are the best place to park money. We know that this can change quickly so I'm not reading too much into this rally.

Job growth around 200K would be perfect. It would suggest sluggish growth and it would not be strong enough for the Fed to hike rates next week. On June 23rd England is likely to stay in the EU and this news could spark buying as well.

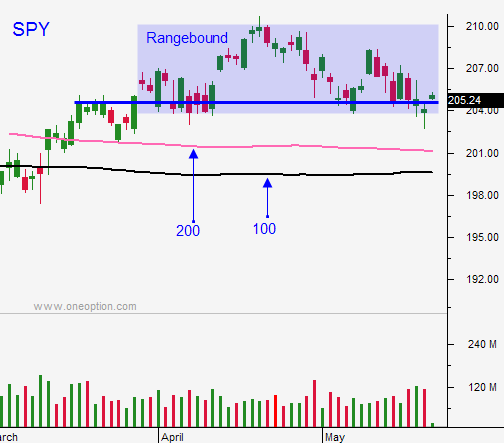

The market is challenging SPY $210 and it could float higher on light volume.

So we need job growth of 200K, no rate hike and no Brexit for the market to grind higher and to make a new high.

Earnings growth has slowed dramatically and stocks are fully priced at a forward P/E of 17.

The path of least resistance is higher and I will day trade from the long side today. I know that I won't have much help from the market so I will set meager targets. My goal is to make $.40 on a few trades today and that is about all I can expect.

If the scenario I outlined pans out over the next few weeks and the market breaks out, I won't hold any overnight longs until I see the breakout hold for at least a week.

Look for very quiet trading today and a bias to the upside. Make your money early and set targets.

.

.

Daily Bulletin Continues...