Buy Calls Today If This Happens – Market Wants To Breakout

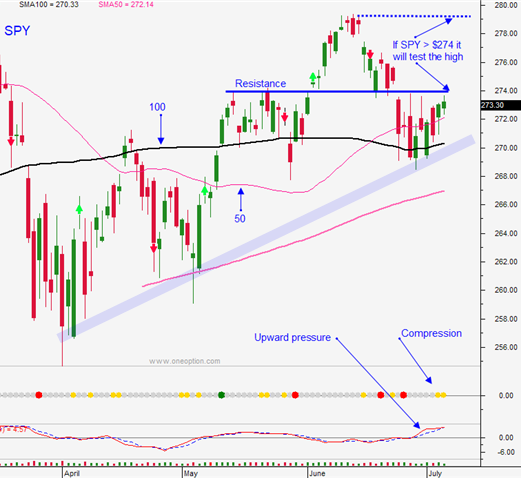

Posted 9:30 AM ET - Yesterday the market retreated on trade war concerns. Trump outlined the second tranche of taxes and China vowed to retaliate. The damage was relatively contained and that is a sign that buyers are still engaged ahead of Q2 earnings season. The SPY, QQQ and IWM are bumping up against major resistance and solid quarterly profits should fuel a breakout.

J.P. Morgan Chase, Wells Fargo and Citigroup will post results before the open tomorrow. Banks have lagged in recent months and they have upside potential. They passed the stress tests, economic growth is strong, unemployment is low and interest rates are poised to move higher. These are all positive events for the financial sector.

Corporate profits on the S&P 500 are expected to grow 21% this quarter on a year-over-year basis. That is on par with April's results and there have not been many warnings. Guidance could be a little tricky given that new tariffs could be imposed during the quarter. Generic cautionary remarks should not dampen investor spirits. At a forward P/E of 16, stocks are reasonably priced and they have room to run.

Trade war squabbles will continue. China has threatened to boycott US goods and to sell US Treasuries. I doubt it will get to this point, but if it does credit markets will suffer. China's real estate bubble is monstrous compared to the domestic crisis we saw a decade ago. Domestic financial institutions have deleveraged and credit risk is much lower for the US on a relative basis. Trump knows this and he will use it to his advantage during trade negotiations.

The market wants to go higher, but option traders need to tread cautiously. It might take a little more time for major indices to breakthrough horizontal resistance. Once they do, they will fly. Time decay is currently an issue for call buyer's and I suggest waiting for that breakout. Pullbacks like the one we saw yesterday are damaging to call buyer's because it takes time for the market to recover and to challenge the high. If the QQQ closes above $178 today buy calls. Swing traders are still long IWM and I suggest using $167 as your stop on a closing basis.

Day traders need to see if the gains hold. Look for early selling pressure. If the bid holds for the first hour the market will grind higher and it could challenge major resistance levels today.

Wait for the breakout on major indices and be ready to buy calls.

.

.

Daily Bulletin Continues...