Market Is Climbing A Wall of Worry – Place An Intraday Stop At This Level

Posted 9:30 AM ET - The market is climbing a wall of worry. Tariffs are dominating the headlines and trade negotiations are ongoing. As long as the dark clouds don't produce any lightning, buyers are nibbling. Stay long and have an intraday stop in place.

The major news over the weekend is that Trump is pushing for trade talks with China next week. Tariffs could be reduced from 25% to 10% and they will be delayed until trade officials meet. China is suggesting that it could restrict exports that are critical to US manufacturing. I don't believe the trade negotiations will yield any fruit before the November elections, but the rhetoric should calm down.

Trade negotiations with Canada and Europe are progressing. A deal would spark a rally.

The FOMC will hike rates a week from Wednesday and the tone will be hawkish. Wage inflation is a concern and the Fed will keep its foot on the brake.

Credit conditions in emerging markets are fragile but stable. This can change quickly and I check global yields each morning.

Domestic economic growth has been strong and the calendar is light this week.

Congress should pass a budget in the next two weeks and the threat of a government shutdown is small.

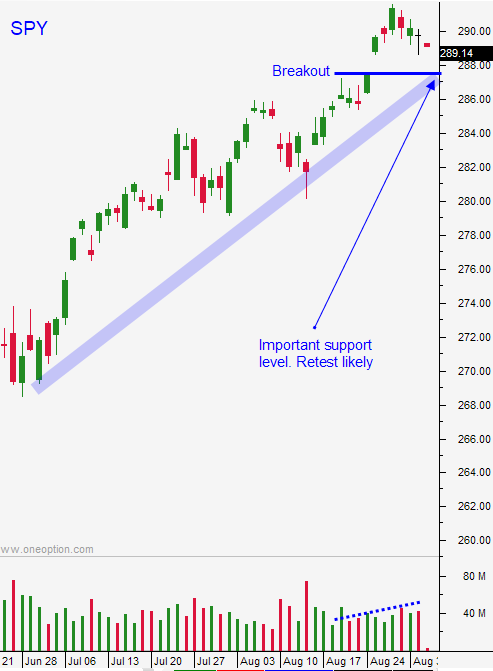

Swing traders are long SPY. We will use SPY $287 as our stop on an intraday basis. Stocks want to move higher, but they are fighting a stiff headwind at the all-time high. The market tested the breakout a few times and support was established at $287. This is a bullish sign.

Day traders should let the market come in this morning. Overseas markets were soft so be patient and make sure that support is established. I believe it will take an hour or two for that to happen. Look for opportunities to get long. If the SPY is above the first hour high you can get more aggressive with your longs.

Calendar is fairly light this week and the action could be lackluster.

.

.

Daily Bulletin Continues...