Market Rally Needs Fantastic Earnings – Global Backdrop Is Deteriorating

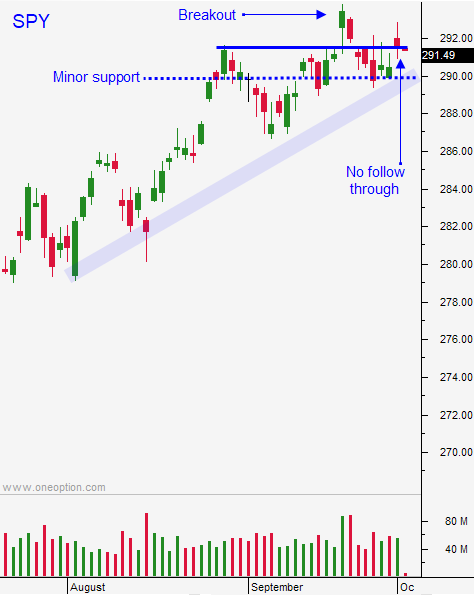

Posted 9:30 AM ET - Yesterday the S&P 500 tried to challenge the all-time high but it did not have enough impetus to breakout. The US trade deal with Canada was largely priced into the market and the euphoria quickly wore off. As I mentioned in my comments there are too many headwinds. Stocks retreated from the high of the day and we are seeing selling pressure this morning.

Trade has been a primary concern and the backdrop is improving. USMCA will replace NAFTA and negotiations with South Korea and Japan are heading in the right direction. Europe is very fragmented and I'm not expecting a deal this year. They have other concerns and I will address them later.

Relations with China are deteriorating and the two largest economies in the world are exchanging punches. Yesterday Trump said that it is too early to negotiate with China. They have been ripping us off for far too long. This type of rhetoric tells me that a deal will not happen anytime soon. China is hankering down for a long battle and their media has been instructed not to mention any economic weakness. The PBOC is ready to inject liquidity. US naval exercises in the South China Sea have increased and the US just sold arms to Taiwan. We need to watch China's shadow banking industry ($16 trillion) for defaults.

Europe is struggling to hold its union together. Italy plans to run a large deficit (2.4% of GDP) next year and that is well outside of the EU's guidelines. Italian yields have spiked. The EU also has another member (Turkey) that is dangerously close to a credit crisis. Brexit negotiations with England have been nasty.

The November elections currently favor Democrats if you trust the polls. If Democrats win the House (expected) they will obstruct Trump more than they already are. If the Democrats also managed to win the Senate they will stop Trump's agenda dead in its tracks. The market will correct if this happens.

The S&P 500 is trading at its highest P/E premium relative to other markets in 10 years. Global investors like the backdrop in the US and the S&P 500 is expensive relative to other indices. Stocks are priced for perfection and any earnings warnings will spark profit-taking. China is our largest trading partner and tariffs could impact profits.

Domestic economic conditions are strong. ISM manufacturing was good and ISM services should also be good this week. The employment numbers will be strong and the most critical component will be hourly wages on Friday. If they increase .4% for a second straight month, inflation could become a concern and I would expect to see profit taking.

Swing traders should use an intraday stop of SPY $290. If the market falls below that level we will patiently wait on the sidelines. Earnings season will start in a few weeks and that should keep buyers engaged. Profits need to be stellar for the market to move higher.

Day traders should look for an opportunity to short the market. The pullback yesterday came on bullish news and we should've seen a close near the all-time high. Profit-taking kept that from happening and we should see some selling pressure this morning. If the market makes a new low after two hours we should drift down to minor support at SPY $290.

At best we could see a year-end rally to SPY $300, but the move will be very tenuous. There are lots of landmines. Make sure you use intraday stops.

.

.

Daily Bulletin Continues...