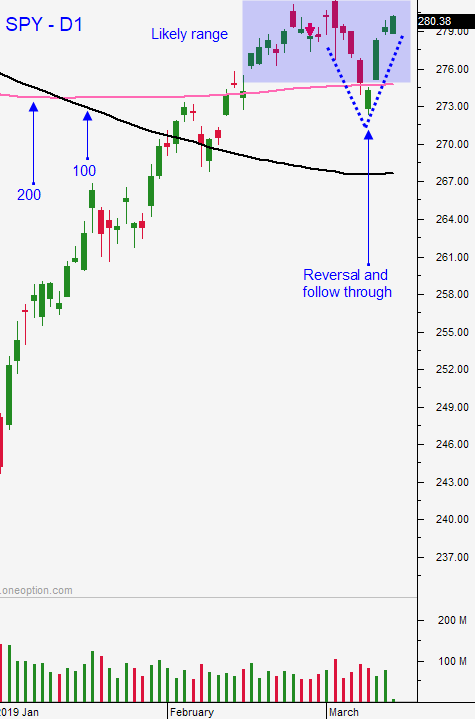

Quad Witching Fueled the SPY Above Major Horizontal Resistance

Posted 9:30 AM ET - Yesterday the market broke through major horizontal resistance at SPY $281. The move was fueled by quadruple witching and investors are ignoring potential warning signs. Look for a gradual move higher the next two days.

The summit with Xi has been postponed and Trump made some cautionary comments about a deal Wednesday. Investors didn't flinch. They don't care if a deal gets done in March or June, as long as it gets done. China's industrial production fell to its slowest growth pace in 17 years and investors didn't care about this either. The PBOC will continue to ease, fiscal spending will increase and VAT taxes might be reduced. I mentioned in my comments yesterday that soft Chinese numbers might not spark selling.

The English Parliament voted against a hard exit Wednesday and today they will vote to delay Brexit by as many as 21 months. This will is likely to pass and this will drag on indefinitely. In the meantime, manufacturers will move production out of England due to uncertainty.

Soft global economic growth is not currently a concern for the market.

Last September stocks defied bad news and when the selling surfaced it was heavy. A similar situation is setting up now, but we will get out of the way of this freight train.

Swing traders were stopped out of the short SPY position yesterday when it closed above $281. We will remain on the sidelines. The market is likely to compress in this area while unresolved issues play out. During that time economic conditions will continue to slip and technical support levels will eventually fail. I still believe the upside rewards are smaller than the downside risks at a forward P/E of 16.5.

Day traders should favor the long side since we are above SPY $281. Quadruple witching will fuel the move higher now that we are through horizontal resistance. If we are above the first hour high you can get more aggressive with your longs today.

We are in a news vacuum for the next few days.

.

.

Daily Bulletin Continues...