News Vacuum – Market Will Compress For A Few Weeks

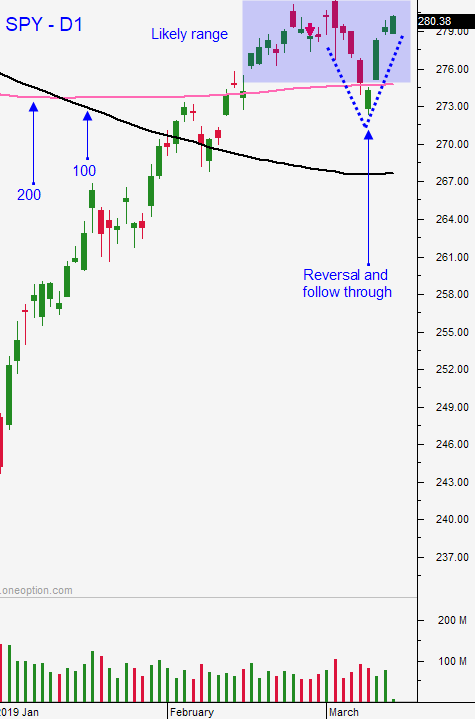

Posted 9:30 AM ET - The market continues to float higher after the reversal last Friday. Buyers stepped in at the 200-day MA and sellers are passive. The S&P 500 is within striking distance of major horizontal resistance and quadruple witching might push it through. The news is very light.

England will vote for a hard exit today and it will fail. Tomorrow they will vote on a Brexit delay and that is likely to pass. England is in limbo and manufacturers are moving production.

Trade negotiations with China are progressing and the tone is positive.

The FOMC will meet next week. "Fed speak" has been dovish recently. Investors are not pricing in any rate hikes this year and they expect the Fed to end its balance sheet roll-off later this year.

China will post industrial production and retail sales tonight. Soft numbers might not spark a market decline. The PBOC is ready to ease and fiscal spending will stimulate growth. China is also considering a reduction in VAT (value added taxes).

The market is likely to consolidate between SPY $275 and SPY $281. The news is light.

Swing traders should buy the SPY at $277. We are going to reel in our short position. Use a closing stop of $281. We will head to the sidelines while the market compresses. I still feel that surprise favors the downside, but we will wait for that breakdown.

Day traders should look for quiet trading. Quadruple witching usually fuels a decent move, but it does not feel like it is going to happen today. If the momentum builds in one direction, favor that side. As long as the market is trapped inside of the first hour range, trim your size and trade count. Fade the extremes.

This could be a quiet stretch for a few weeks.

.

.

Daily Bulletin Continues...