The Selling Pressure Will Increase Today – Here’s Why

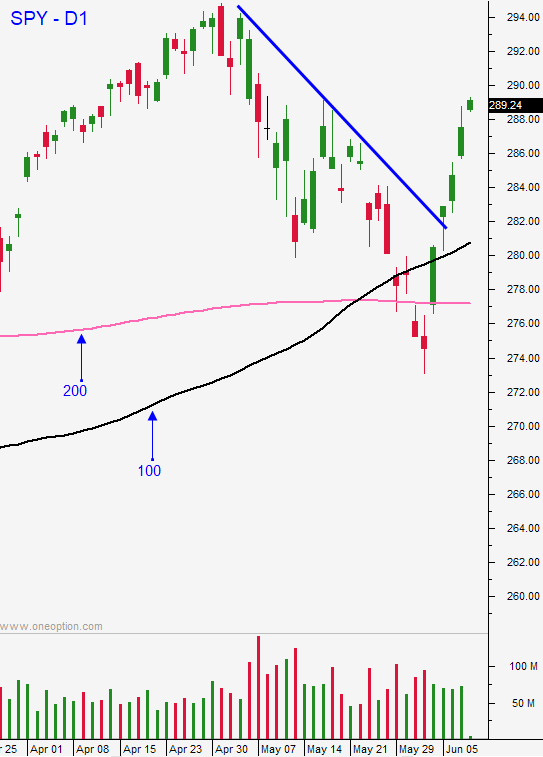

Posted 9:30 AM ET - The market has fallen into a tight trading range this week. A chart of the S&P 500 reveals very small bodies on the daily candles and three of the last four days have finished where they opened. As I mentioned in my comments this week the bounce has run its course and the market will pause before it starts the next leg lower.

Broadcom lowered its 2019 revenue forecast by $2 billion (10%) due to the trade war with China and restrictions related to Huawei. We can expect similar from other chip makers. This is the first substantial earnings warning related to China and Q2 announcements will start in a few weeks. Traders will be watching for other pre-earnings warnings.

China's industrial production fell to a 17-year low (5%) and retail sales were slightly ahead of expectations (8.6%). Traders are not too worried about this news and they feel that China will stimulate growth through fiscal spending and monetary easing.

Trump's economic advisor (Kudlow) said that new tariffs would be imposed if China did not attend the G20 meeting in two weeks. Trump has mentioned similar and it sounds like trade talks might have ended. Xi said last night that he would promote steady development ties with Iran. This comes after the tanker attacks and it defies US sanctions. This does not sound like a country that is ready to negotiate a trade deal. At the beginning of the year I said that a trade deal with China will not happen before the 2020 election. I think that analysts will start to turn more pessimistic.

US retail sales increased .5% and that was in line with expectations.

Swing traders should remain short with a closing stop at the all-time high. It will take a few weeks for the market to revisit the major moving averages and we will be patient. The bad news is mounting and the recent bounce is exhausted. If more tech companies lower guidance due to a tariff war with China the selling pressure will increase. Most major economies have decelerating growth and with each passing month recession concerns will grow.

Day traders should favor the short side this morning. I believe that the Broadcom (AVGO) news could spark profit-taking. If we make a new low after two hours of trading, stick with the short side. If the market is not able to breakout from the first hour range, fade the extremes and assume that the market will close near its open.

The market will establish the low-end of the trading range in the next week and we will be trapped in it for a few weeks. If we have a directional move, it will be lower.

.

.

Daily Bulletin Continues...