Oil Outage Won’t Matter – Bigger Issue Ahead This Week

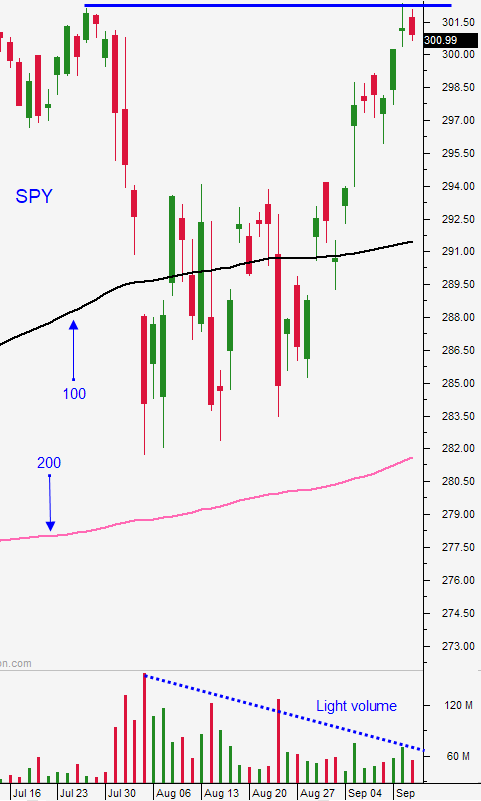

Posted 9:30 AM ET - Last week the market tested the all-time high and it was not able to breakthrough. The prospect of face-to-face trade negotiations with China and easing by the ECB sparked buying. The Fed is expected to lower rates by .25% Wednesday and the market will recover from the early dip this morning.

Iranian sponsored drone attacks destroyed Saudi Arabian oil production. Energy stocks will move higher this morning. Oil futures are up 10%, but this will be a temporary disruption.

Trade negotiations with China don't matter. As long as economic growth in both countries remains stable the market will tread water. The yuan has been weak so consumers are not paying higher prices. There will not be a trade deal before the 2020 election and both sides will calm investor concerns for the next year.

The ECB lowered interest rates by 10 basis points last week and the yield is -.5%. Quantitative easing will resume in November. The ECB is out of bullets and their actions will have little impact on economic growth.

Wednesday the Fed will cut interest rates by a quarter-point. Many analysts are expecting two more rate cuts this year and that is overly optimistic. Domestic economic growth has been strong (ADP and ISM services) and the rate cut this week is unnecessary. I believe that the FOMC statement Wednesday will disappoint doves and the market is likely to dip.

Earnings season is only a few weeks away and stocks are priced for good news (forward P/E of 17).

Brexit was a potential train wreck and it has been postponed until January. As long as credit concerns are minimal the market will try to advance into year end. Historically low bond yields are pushing investors out on the risk curve. They are forced to own equities to maintain purchasing power (negative real returns on fixed income investments) and to generate returns.

Swing traders should remain in cash. I am looking to buy after and FOMC drop. SPY $297 is the first level where we consider buying, but I would prefer to enter around the $294 level. There is no need to chase. Asset Managers are not worried that they will miss the next big move when the market is trading at the all-time high and when valuations are at the upper end of their trading range.

Day traders should look for a buying opportunity this morning. The oil supply disruption will be temporary and the market bid has been strong. Stable economic growth in the US/China combined with central bank easing will attract buyers ahead of the FOMC.

.

.

Daily Bulletin Continues...