Here’s How To Trade the FOMC Statement Wednesday

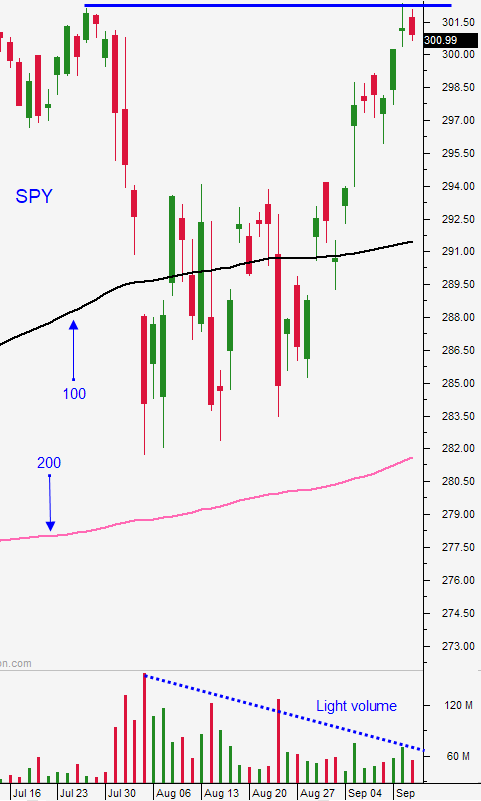

Posted 9:30 AM ET - From a trading perspective the big news is that 13 out of the last 15 days have seen below average volume. We are constantly in "wait and see mode". The news comes out, we get a one-day move and then we sit. That's where we are right now and everyone is waiting for the FOMC statement tomorrow.

Fed officials are divided with some demanding aggressive rate cuts and others favoring no action the rest of the year. The market is pricing in three rate cuts before year-end. We are very likely to get a quarter-point rate cut tomorrow, but the rhetoric is likely to disappoint doves. Domestic economic growth is strong and global weakness has yet to spread to the US.

This is quadruple witching and we can expect some volatility after the FOMC statement tomorrow.

Earnings season is only a few weeks away and there have not been many warnings. At a forward P/E of 17 stocks are trading at the upper end of their valuation range.

China is sending a delegate to set the framework for an October trade meeting. This should keep investors calm and that is all both sides want. They are miles apart and a trade deal will not happen before the election.

Boris Johnson is rattling his sabers and he claims that England will leave the EU on October 31st. That will be an uphill legal battle for him and he is looking for loopholes to make it happen.

The oil disruptions in Saudi Arabia are a temporary blip on the radar.

Swing traders should remain in cash. I believe that the FOMC statement will disappoint doves and that we will have an opportunity to buy a dip. Ideally we will test the breakout at SPY $294. That is where I would like to buy for a year-end rally. Asset Managers won't chase stocks at the all-time high and neither will we.

Day traders should look for quiet conditions. The price action has been very choppy and you need to focus on stocks with relative strength. We are using Option Stalker searches to find them. The market will open lower and I will be looking for stocks that are moving higher (relative strength) on heavy volume. These are the two key components to watch for. Make sure you include relative strength and heavy volume in your searches.

Support is at SPY $297 and $294. Resistance is at $302.

Look for very quiet trading until the FOMC statement.

.

.

Daily Bulletin Continues...