Big News Events This Week – Here Are the Likely Outcomes and Market Reactions

Posted 9:30 AM ET - Last Monday the market sold off on concerns that a US/China trade deal might not happen. Stocks gapped lower on Tuesday and reversed during the day forming a bullish hammer. This price action tells us that the bid is still strong. Major events are scheduled this week and they should be market neutral at worst

On December 15th new tariffs could be imposed on China. Trade negotiations continue and the rhetoric has been positive. I believe this is nothing more than lip service and both countries are simply pacifying investors. Trump signed a bill supporting Hong Kong protesters and he will sign another bill supporting Muslims in China in the very near future. This will spark backlash.

Over the weekend China said that all state offices will remove foreign hardware and software within the next three years. The pace will be 30% in 2020, 50% in 2021 and 20% in 2022. This is in retaliation for the Huawei blacklisting by the US. It certainly doesn't sound to me like a trade truce is going to happen. The anti-China rhetoric is playing well with voters and Trump is raking in billions in tariff revenues. China wants all of the tariffs removed and I don't see that happening. The good news is that any related market pullback will be a buying opportunity. A trade truce with China will not impact economic growth.

The real prize is the USMCA and that could be signed before Christmas. It has the potential to add 1% to GDP growth next year.

The FOMC statement will be released Wednesday. Fed officials are content with current policy and I'm not expecting any surprises.

Domestic economic growth is stable. ISM manufacturing and ISM services were little soft, but nothing concerning. ADP was weak, but the Unemployment Report Friday was much better than expected. In short, the economic numbers were solid.

England will hold elections this Thursday. Boris Johnson leads in the polls and if he gains support we can expect a Brexit agreement. That would remove market uncertainty.

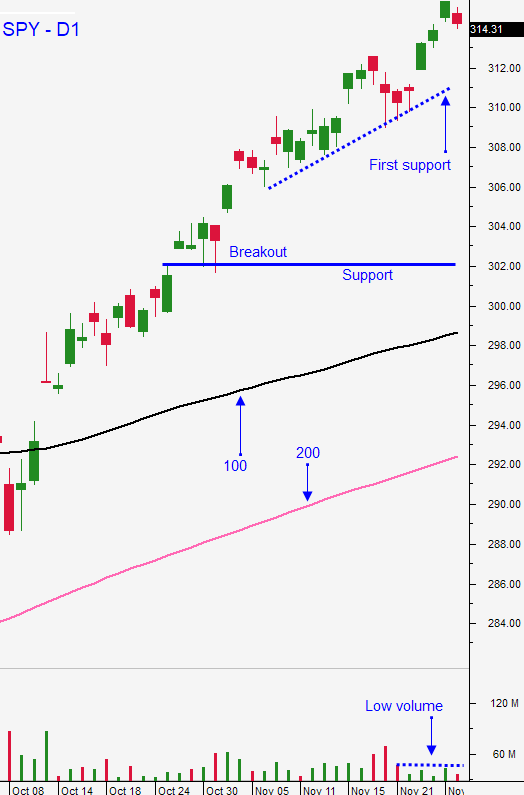

Swing traders should have been selling bullish put spreads since Wednesday. I suggested leaving half of your powder dry and waiting for some of these large events to play out. The US could move forward with new tariffs, but that is unlikely. I believe the talks will drag on and they will extend the deadline. Seasonal strength should also keep a good bid to the market. If tariffs are delayed and the USMCA is not signed I believe that SPY $307 support will hold into year-end. If new tariffs are imposed and the USMCA is passed I believe SPY $307 will hold and we might have a chance to make a new high. Distance yourself from the action and take advantage of time decay by selling out of the money bullish put spreads on strong stocks. Option Stalker searches like PopBull should be used to find high probability set-ups.

Day traders need to be careful today. The market will not help or hinder your stock day trades. Heavy volume is the key. The market is flat before the open and Monday's have been very quiet. I doubt we will see much of a directional move either way given the big news events that lie ahead. Try to find a few good plays and set passive targets. The action should pick up as the week progresses.

Sell bullish put spreads on market dips.

.

.

Daily Bulletin Continues...