Watch For This Market Pattern Today – We Have Seen It the Last 3 Fridays

Posted 9:30 AM ET - Yesterday the market open lower on fears that the Coronavirus spread has been underreported by China. A new method for detecting the virus was used and the number of new cases jumped tenfold. Investors were not rattled by the news and they bought stocks right on the open yesterday. The market bid is very strong.

There is an important pattern to note. Stocks have sold off the last three Fridays and they have rallied on Monday. Concerns that the Coronavirus might worsen over the weekend has spooked buyers on Fridays. They have a chance to reevaluate the risks over the weekend. When they come in Monday morning they are ready to buy. We may see that same pattern today. Monday is a legal holiday and the exchanges will be closed.

This morning we learned that retail sales increased .3%. That number was in line with expectations and it did not have much of a market impact. The economic releases this week have been light.

Jerome Powell's testimony before Congress this week was dovish and the Fed remains accommodative.

Earnings season is winding down and the results have been good enough to keep buyers engaged. Roku and Nvidia posted solid numbers after the close yesterday. Even at a "rich" forward PE of 18, investors have not been shaken by the potential economic impact from the Coronavirus.

Swing traders should keep selling out of the money bullish put spreads. This options trading strategy gives us a little breathing room and we can distance ourselves from the action. It also takes advantage of time decay and I like selling these spreads inside of two weeks. If the market does have a moment of weakness these stocks should hold up relatively well and we also have technical support levels that we are leaning on. The key is to find the right stocks. I am using Option Stalker to find post-earnings plays where the reaction has been positive and where the stock displays relative strength. I also want to see heavy volume. When I have these ingredients my probability of success increases dramatically. I don't see any market speed bumps ahead, but I also don't see any huge catalysts to fuel a big rally.

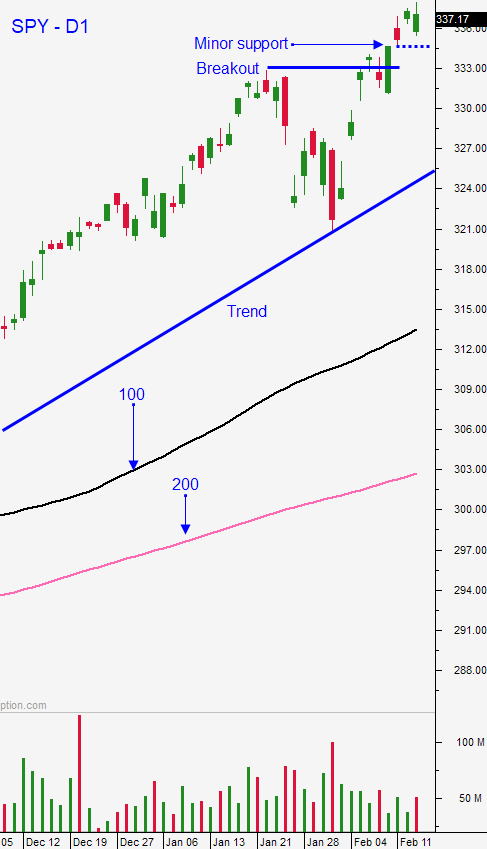

Day traders should focus on strong stocks. It's been difficult to trade the S&P 500 during the day because the price action has been relatively choppy. The exception is a gap lower. On those days the market has been able to rebound quickly and bullish trend days have been common when we open lower. Today the market is going to open slightly higher and we are probably going to spend the first hour of trading probing for support. We have been able to find strong stocks in the chat room and that has been our primary focus. If you look at the daily chart of the S&P 500 you will notice that there are many tiny bodies. That means that the market tends to close near its opening price. Look for a fairly range bound day and watch for possible late day selling.

Support is at SPY $336.

.

.

Daily Bulletin Continues...