Consumer Spending Will Determine Market Direction – The Next Few Weeks Are Critical

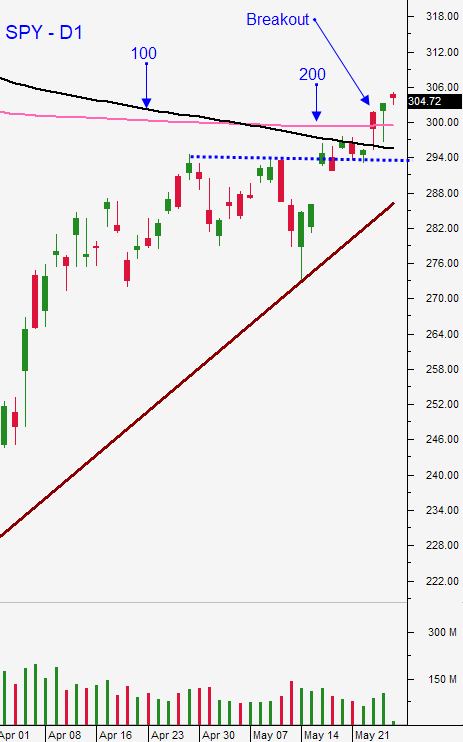

Posted 9:30 AM ET - The market was able to rally above major resistance last week and it was able to hold the gains. SPY $295 is a critical level and you should use that support as your guide. As long as we are above it, focus on strong stocks with relative strength and sell out of the money bullish put spreads. The market is likely to tread water at this level while businesses reopen. Consumer spending is the key to this recovery and we will have clarity in a few more weeks.

The spread of Coronavirus has been declining steadily for the last few weeks. This is true on a domestic and on an international basis. More people are being tested and the base is being established. Fear is subsiding and people seem ready to return to their normal lifestyles.

We don't know if consumers will be cautious or if pent up demand will spark a quick economic recovery. It seemed like the country was ready to get back on track a week ago, but the riots last weekend have taken a psychological toll and retailers are closing stores in ‘hot spots”.

The Caixin Markit PMI came in at 50.7 suggesting that China's manufacturing activity has rebounded nicely. The country still expects GDP to grow at 4% this year, but demand for exports has been soft while the rest of the world struggles to recover. China emerged from the Coronavirus two months ago and they are the litmus test.

Last Friday President Trump did not impose addition tariffs or trade sanctions against China during his press conference and that has investors breathing a little easier. Without question, tensions between the two countries are on the rise.

After the open, ISM manufacturing will be released. ADP and ISM services will be posted Wednesday. On Friday we will get the Unemployment Report. This is a fairly heavy week of economic releases, but most of them are backwards looking. Horrific numbers will not spark selling as long as the recovery is showing signs of progress.

Fiscal and monetary stimulus is planned across the globe and this safety net is boosting investor confidence. The market bid is strong and Asset Managers are erroring on the side of being long. Good news is price then and in my opinion the market will do well just to tread water this summer.

Swing traders are long the SPY at $300. Place an intraday stop at $301 and set a target of $305. One way or the other, we will take profits. I was hoping for a little better follow through to this breakout and since we didn't get it, we will exit our position. Swing traders should continue to sell out of the money bullish put spreads on strong stocks. Distance yourself from the action and sell these put spreads below major technical support. Take advantage of time decay and generate income while we wait for clarity. If support at SPY $295 is breached, buy back your put spreads. I am not worried that we are going to miss the next leg of a big market rally.

Day traders will be able to find opportunities on both sides of the market intraday. Many stocks have rallied to resistance and prices are fairly frothy. Weak stocks have had decent follow-through intraday and you can make money on the short side if you have a little help from the market. I still prefer to trade from the long side because the S&P 500 is above major resistance. However, it is harder to find stocks with strong upward directional movement. This tells me that the market is getting tired and that buyers and sellers are paired off. Trim your size and reduce your trade count in this low probability trading environment.

Expect choppy price movement while we wait for clarity the next couple of months. Support is at $300 and $295 and resistance is at $307.

.

.

Daily Bulletin Continues...