Market Bid Is Strong – Money Flowing Into Stocks During Uncertainty

Posted 9:30 AM ET - The S&P 500 futures are pointing to a 60 point rally pre-open and there is resistance at that level. Democrats will retain control of the House and Republicans will retain control of the Senate. However, the presidential winner will not be determined for at least a few days and the results are likely to be contested. From my perspective this is the worst outcome because the market does not like uncertainty.

Major media is not declaring a winner because the races are razor thin and many votes still need to be counted. From what I am hearing from various sources (conservative and liberal) is that mail-in voting still has to be counted and that favors Joe Biden. Regardless of who wins the remaining key states, the loser is likely to contest the results. A delay in the presidential outcome will also delay a much-needed stimulus bill.

I'm trying to rationalize the opening rally this morning and I have to conclude that "insiders" believe that this will NOT come down to Pennsylvania. That state is a procedural nightmare when it comes to mail-in voting.

This morning we learned that 365,000 new jobs were created in the private sector during the month of October. That is 300,000 fewer than analysts had expected and this wave of the Coronavirus is taking its toll on employment. This might bode poorly for Friday's Unemployment Report. This morning, ISM services will be posted after the open.

Earnings season has climaxed, but there are still many companies that are reporting. Start valuations are stretched at a P/E of 23 and the current wave of the Coronavirus will weigh on Q4 profits.

The market rally this morning is bullish from my perspective. During a time of uncertainty, money is flowing back into the market. With 0% interest rates, stocks remain an attractive investment alternative. I would not jump into the opening gap higher this morning. Wait for the bid to be tested and then sell some out of the money puts on stocks with relative strength. Don't go overboard and know that there could be volatility if the election results in key states are contested. This was the worst case scenario for the election in my opinion and we need at least another day to get a sense for how this might all play out.

Swing traders should remain in cash. If you are aggressive you can sell a few out of the money put spreads. We will have plenty of opportunities to sell out of the money bullish put spreads once we have clarity. We don't want to be blindsided by election litigation that drags this on for weeks so I suggest being very passive.

Day traders should expect volatility. This is a massive gap higher so most of the gains are likely to hold. It would be unusual for us to completely reverse a huge move like this, but we could give some of it back. Wait for the bid to be tested. If the market shoots higher like a rocket from the open we are likely to hit the high of the day in the first hour and compress the remainder of the day. If the market drifts lower and we fill in some of the gap an excellent buying opportunity should present itself. Pick your points carefully and don't chase.

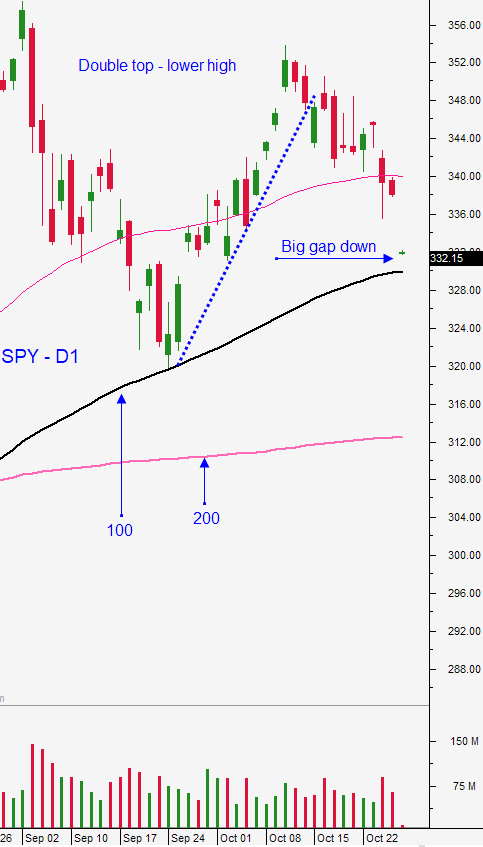

Support is at SPY $342 and resistance is at $349.

.

.

Daily Bulletin Continues...