Question

Over a year ago, I featured this question in my option trading blog. The market conditions have changed, but the concept has not. Lee T. asks, “Can you recommend a stock that I can use as a proxy for the S&P? I would like to make directional bets on the market for seasonal trends such as a year-end rally, and swing trades spanning a few days or weeks. But options on SPY don’t seem to work well since the SPY has a historical volatility of six. I’ve seen some people use GOOG as a market proxy but I am also not wild about options on a $400/share stock that trades on the NAS. Are there any NYSE stocks that might work better?

Answer

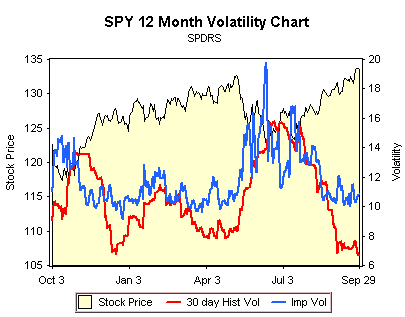

Lee points out that the SPY (S&P 500 depository receipt) has a very low historical volatility of 6. That is depicted in the chart below by the red line. As you can see, the blue line represents the current implied volatilities of the SPY options and they are near a 1-year low of 11. The charts are one of the nice tools provided by optionsXpress

The SPY is less volatile because it is a diversified basket of stocks. If one of the component stocks is down $10 it won’t have much of an impact on the value of the index. That’s why I believe the major indexes are better suited for option selling strategies – UNDER THE RIGHT CONDITIONS! These are not the right conditions. The historical implied volatilities of the options are at unprecedented lows. This is a time to be long premium.

If you are a purchaser of calls and/or puts (premium buyer), you have limited risk and you want the “surprise element”. You live for big moves and you won’t get them in a broad-based index (i.e. OEX, SPX, SPY). Lee is looking for a more efficient way to play the year end rally.

I accomplish this by finding a stock with relative strength. It will lead the market higher and hold it’s own when the market drops. This behavior creates an edge since I can get the market wrong and not have my head handed to me. We made a new all-time high on the Dow Jones Industrials today and we are coming up on year-end strength.

In this market environment, I want a stock with good earnings, a strong chart, tight price patterns and upside. Everest RE Group (symbol RE) came up on my BDCE-Breakout scans today. It is a reinsurance company that trades at a 1-year forward P/E of 8 according to Yahoo Finance. The hurricane season has passed, insurance premiums have been hiked and Katrina is in the rear view mirror. This stock has a chance to move at least $6 higher. At it’s annual high of $106 it would still be trading at a P/E of 9. Let’s see if it passes the litmus test.

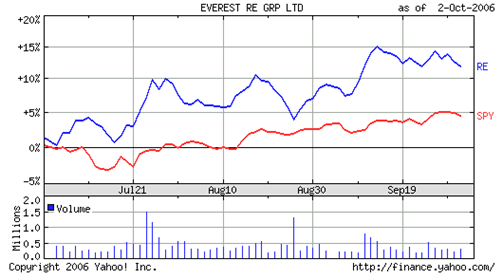

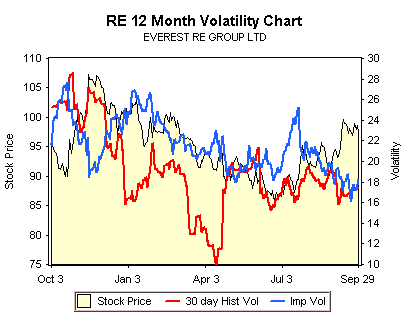

Judging from the 3-month chart, it appears that RE is strong relative to the SPY. The next step is to see how the options stack up. In the chart below you can see that there is not much difference between the historical volatility of the stock and the implied volatility of the options. You don’t see this often since the IVs are usually higher. In this case, we are getting a “good deal”.

If I look at the October 100 calls, they finished the day just out of the money and they closed $1.35 x $1.50. That represents an IV of 16 and they seem cheap for a stock that was just up $2.85. The stock made a new relative high and there are 2 1/2 weeks until expiration. I selected these options simply based on Lee’s desire to get in and out of a position. If he were looking for a longer term trade, an in-the-money (ITM) Nov 95 call purchase could have made sense. Your strategy is determined by your opinion of the stock and your confidence in the analysis.

This stock just made a big move up, don’t chase it. It might make a nice play on a pull back, IF YOU ARE BULLISH. As an exercise, overlay RE, GOOG and the SPY to view the relative strength of each. Which one would you want to be long? One final note, Lee asked if I can give him one stock to use as a proxy for the market. My answer is no. It changes constantly and it depends on my bias. If I were bearish, I would go through the same exercise and find a very weak stock.

In my primary option trading blog I will be discussing how my opinion and confidence determine my option strategy. It is the next step in my series, “How I Trade Options.”