Table of Contents

Tip 1: Always Remember When Day Trading Stocks: “Market First, Market First, Market First”

The foundation of successful day trading stocks hinges on a fundamental principle that’s often overlooked—prioritizing the market. Amidst the eagerness to dive into trading, many overlook this essential factor. The market’s movements are not just a backdrop; they are the primary drivers influencing individual stock performances.

The single biggest mistake I see traders continue to make is as obvious as the nose on their faces. I see this mistake so often that I hammer this point home 4-5 times a day. Even then this basic concept does not sink in for many traders and they discount its importance. I often bait traders with a question looking for this one simple answer and they still miss it. If you learn nothing more from me I hope you will learn this: Market first, market first, market first.

The Eagerness Pitfall: Rushing Into Trades and Its Pitfalls

New traders day trading stocks often fall into the trap of impulsively jumping into trades without considering the overarching market scenario. The allure of pre-open gainers and instant opportunities becomes their sole focus, leading to hasty decisions based on fleeting market movements. However, the real secret lies not in instant actions but in patience and strategic market observation.

Aspiring traders can’t wait to turn their screens on. They start looking for day trading stocks with pre-open gainers and then that becomes their entire focus. OMG, $TSLA is running… gotta grab some calls. OMG @HariSeldon is already in 3 trades in the first 10 minutes, I better buy something. Time stops and the stock “du jour” becomes their entire universe.

Later in the day, I field questions like: How do I improve my entry? How can I improve my exits? How can I improve my win rate when day trading stocks? Where should I place my stops? I ask for a trade example and in almost every instance the trader was oblivious to what the market was doing. I will do articles on all 4 of these questions, but the most important one is, “How do I improve my win rate?”

The Prime Question: How to Improve Win Rates in Day Trading Stocks?

If you get your win rate above 75%, the rest is fine-tuning. You will only get to that level if you are hawking the market. In previous articles, I have written about context and the importance of getting your market bearings before the open. Market analysis is 65% of the puzzle, but it takes time to develop this skill so let me give you something you can use tomorrow.

Tip 2: Waiting for Market Pullbacks

Waiting for market pullbacks when day trading stocks is simple yet often disregarded: refrain from entering trades until the market undergoes a pullback. This necessitates discipline—a gap up demands patience for a market drop, while a gap down requires confirmation of support. This simple tactic, often underestimated, is the bedrock for entering favorable trades.

Do not place a trade until the market pulls back. That means on a gap up you sit on your hands until you get a market drop. On a dull open you sit and wait for a dip. On a gap down you can trade earlier, but you have to make sure that support has formed. Most of you will dismiss this suggestion next time you hear it. You won’t have the patience to wait and you will think the concept is so basic that it’s silly. Some of you might last an hour without a trade and you will get sick of watching “winners” shoot by and you will start day trading stocks .

Interested In Learning More?

The Benefits of Patient Observation During Market Dips

During market dips, the potential for identifying Relative Strength while day trading stocks amplifies. Strong stocks weather market storms, exhibiting resilience and signaling bullish momentum. By aligning trades with these sturdy stocks, traders position themselves for more robust gains once the market stabilizes.

Even during this incredible market rally, there has been a dip almost every day and you can see that in the first chart below. Here are the benefits of waiting for that drop when day trading stocks:

- As the market drops, Relative Strength will be easier to spot. Stop bottom fishing weak stocks! I want stocks that are strong as @#$%, are breaking through D1 technical resistance on heavy volume and that are above the prior day’s high. From this list look for stocks that have held strong during the market dip. Most day trading stocks follow the market and when they don’t drop, their strength is revealed.

- The market drop will provide a better entry point because the stock has pulled back.

- The dip will allow us to join the longer-term market uptrend (this is a very important point because we would short stocks on rallies if the long-term market trend was down).

- Once the market finds support, the market bounce will provide a strong tailwind and the stock will slingshot higher.

Tactical Precision: Stalking Stocks in Alignment with the Market

Strategic trading involves meticulous observation of stock behavior relative to the broader market ($SPY). This vigilant comparison enables traders to identify prime day trading stocks that align with market movements, ensuring they aren’t chasing poor candidates but rather are positioning themselves for potential profit surges.

When the market is drifting lower, you need to stalk the stock tick-for-tick vs the $SPY. $SPY has a red M5 bar and the stock has a green M5 bar – excellent. Now you know you have the right prey in your sights, you just have to wait for the market to find support. When the market finds support the stock will release like a coiled spring and you will have an instant winner on your hands.

If the day trading stocks do not release immediately (and they should) you can give it 10 minutes, but you want to see those same aggressive buyers step up on that market bounce. If they do not, you should be prepared to stop the trade out. In many cases the stock will jump (even before the market finds support) and then you are in profit management mode.

Entries are critically important when day trading stocks. If you are constantly getting stopped out, your entry is $H!T. If you use this method you will find that stops are no longer an issue because the stock lifts off right away and you can place your stop at your entry price. If the market did NOT find support and it has another leg lower, the stock should hold up relatively well, but you should be on high alert to stop out (especially on a long red SPY candle). It means that you were wrong and that the market did not find support.

Interested In Learning More?

Importance of Selectivity: Quality Over Quantity in Trades

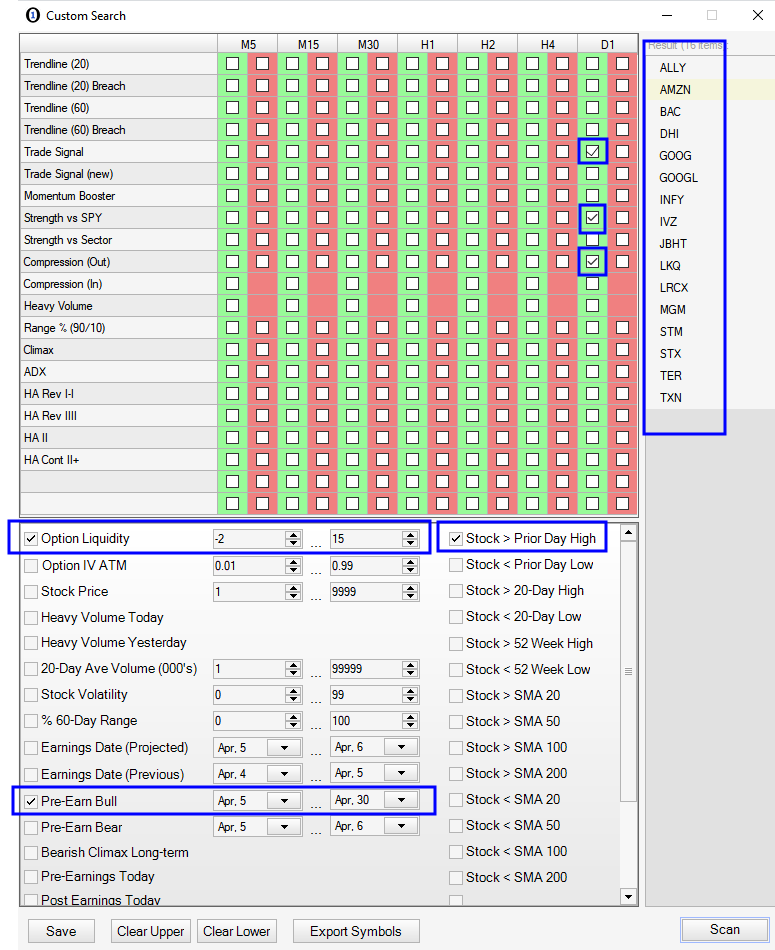

When I am day trading stocks I have my main chart up in Option Stalker so that I can flip charts quickly using searches. Tucked behind the main screen is the last 40 minutes of the $SPY so that I can constantly monitor what the market is doing. If I have a stock on my radar I will not pull the trigger right away. I will watch a few bars and compare them to the SPY.

The second screenshot below is my setup. SBUX shows the 5M price action for the entire day so that you can see what happened. In the SPY chart, I went back to the support level where we had a bullish engulfing pattern after a bullish 1OP cross (which is predictive/early).

Most novice traders do not know how to short and they do not want to short. That is OK, especially in a bull market like this. If you are a “long only” trader it means that you have to patiently wait for those market drops when day trading stocks. No market drop, no trades.

Stop thinking that you have to do 10-20 trades a day to make money. If you waited patiently for SBUX to set up, that one trade is all you need.

Conclusion: Embrace Market-Centric Trading for Success

When day trading stocks, the adage “Market First” is your most important tool By anchoring trading decisions on astute market analysis, traders set themselves up for success, capitalizing on strategic entries and bolstering their win rates. Do this by waiting for market pullbacks for a good entry.

There are more than 100 variables to a good golf swing. When people seek advice from golf pros (myself included) they usually have some preconceived notion of what is wrong and they want the pro to fix it. The pro has you take a few swings and the very first thing they look at is your grip. If you have a bad grip, you will not improve your game. No matter what you think is wrong, you have to fix your grip. In trading, you have to start with the market. Market first, market first, market first!

Trade well.