Daily Stock Option Trading Strategy

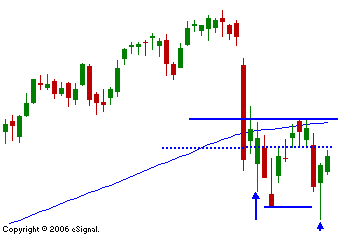

The market dropped yesterday on the open and it looked like the selling would spill over from Tuesday. By mid-day, the bid reappeared and prices moved back up. On a chart, this had the look of a key reversal and many traders might be designating this as a double bottom. I did not see the volume on the sell off or the rally back to tell me that the lows are in. The "V" bottom will be formed when there is fear and volume on the way down and confidence and volume on the way up. I am bearish and these snap back rallies are wearing me out. However, I know the same is true for the people who are long and trying to "get whole". Each time the market rallies, it needs to find resistance just a little lower. Eventually, the market will drift lower and test support. When it fails to bounce after a sell off and we get 2-3 days of consecutive selling, that is when the fear will set in. We have not seen that yet and bullish speculators have not been scared out yet. The blue arrows show the sharp snap back rallies. Notice how we made a new intraday low Tuesday. The blue dotted line represents the opening price from Tuesday (SPY 140.50) and it should provide resistance. I'm looking for lower highs to form and for the SPY 141 level to form resistance. I'm surprised that the market has been able to shrug off the "hot" PPI number. I'm chalking it up to traders believing that yesterday was a key reversal and a double bottom. If this buying dries up in the afternoon, the downside will be tested. All hopes for a Fed ease in July should be dashed with today's inflation number. That means that lenders and home builders will just have to work their way out of this trough. I continue to be bearish as long as the SPY is below 141 on a closing basis. I am long puts and I will continue to hold them as long as that level holds. If we breakout to the upside, I will go to cash for a few weeks.

Daily Bulletin Continues...