Stock Option Trading Strategy – Bull put spreads.

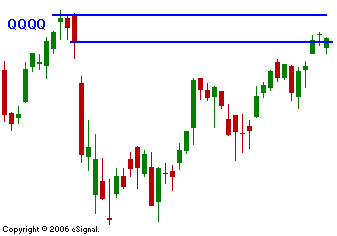

Financial stocks are pushing the market higher and they are off-setting weak results in the tech sector. The market liked what JPM had to say, but MOT, IBM and YHOO raised concerns. These big cap tech stocks may be setting the tone for the sector and the market needs them if it is going to sustain the breakout. There are still many tech stocks on deck, but we need to see better results. In the chart you can see that tech stocks have yet to breakout to new highs. Energy stocks are also taking a break today. The path of least resistance is up and global markets are forging ahead. If the earnings reports meet expectations and we see a 4% earnings growth rate, I believe the rally is still on. Buy-backs, M&A and private equity deals have created a feeding frenzy and I don’t believe the bears will be aggressive unless something major happens. As long as SPY 144 holds, stay long. I am market neutral and I am content with my bull put spreads at this stage. If the earnings come out strong, I might add to those positions. I am less concerned with missing and upside opportunity than I am with having the rug pulled out from under me. Today looks like it will be quiet and the upward momentum has stalled. That will keep a lid on expiration related program trading. Traders need to see a strong directional intraday move for them to leg out and they will not get one today.

Daily Bulletin Continues...