Stock Option Trading Strategy – Long call options on energy and heavy equipment stocks.

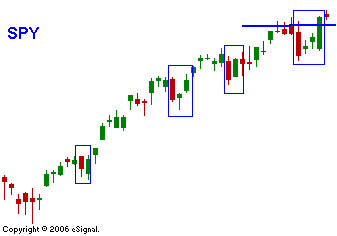

Yesterday the market started off on a very weak note. The Chinese government increased the stamp tax for stock trades by .2%. Their market in turn sold off more than 6%. As I mentioned that event was being sensationalized by the media and they were talking about a tripling of the stamp tax. The increase is inconsequential to a trader that is engaging a market melt up. Given time, our market rallied off of the lows and it rocketed higher. As you can see in the chart I have once again drawn blue boxes around the market pullbacks. Last Thursday's decline was a head fake. All it did was to bring out more buyers. Even the tech stocks participated in yesterday's rally. The QQQQs made new multiyear highs and that rally is continuing today. Stocks like GOOG, GRMN, NVT, RIMM, and AAPL are leaning that sector higher. Not much can stand in the way of this market. The Unemployment Report is due out tomorrow. It has been a non-event for the last few months and if anything, I expected it to spark a bullish reaction. A higher unemployment rate would simply renew hope this of an interest rate cut by the Fed. The bulls will put their positive spin on the event and the market will grind higher ahead of “merger Monday”. I still like energy and heavy equipment stocks and I am gradually adding call positions to the latter. Today I expect the market to quietly march higher.

Daily Bulletin Continues...