Thursday’s Stock Option Trading Strategy

Buy call stock options on basic materials, tech and industrials. Option trading will be brisk as the market makes new highs.

Yesterday, the market tried the downside early in the day. AA, MON, and CVX all missed their numbers and that weighed on the market. By late afternoon the market reversed direction and those losses were almost erased.

An overnight rally in Asian markets pushed those stocks to new highs and it provided a springboard for our market this morning. At 7:30 a.m. CT, retail sales were released. As I mentioned yesterday, a worst-case scenario was already priced in. The news was rather dismal, however many retail stocks rallied after the release. That provided additional fuel for the rally.

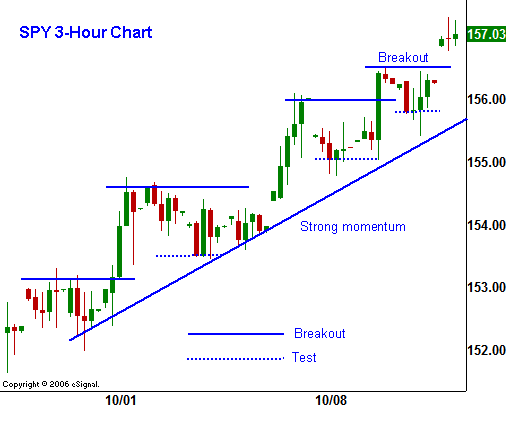

The market is currently trading at new all-time highs. As you can see in the chart, the market breakouts and then it retests that move. Once support is established, it rallies and breaks out to a new high. This is a very strong, methodical trading pattern that prevents the market from getting overheated. The path of least resistance is higher and you should look for opportunities to get long on any dip.

I still like the same sectors that I have been touting. Stay long basic materials (agricultural, mining), international industrials (infrastructure, heavy equipment) and technology (communications, biotech).

For today, I expect the market to grind higher. It has the backdrop it needs and the path of least resistance is up. The bears have been badly beaten and they will not jump in front of this freight train. The early momentum has been established and it is likely to continue.

Tomorrow, GE announces earnings before the open. I'm expecting a solid number and this stock can fuel the market on the notion that income from global expansion can offset domestic weakness.

Stay long.

Daily Bulletin Continues...