Thursday’s Stock Option Trading Strategy!

Expect volatility and tough short-term option trading conditions. During earnings season, I trade stock options on companies that have already announced. I might miss some of the move this way, but my risk is greatly reduced.

After a sharp early sell-off, stocks were able to reverse direction yesterday. The intraday volatility was wild as the market digests earnings news.

This morning, weakness in Asian markets did not dampen our spirits. The Shanghai Index was down almost 5%. China’s economy expanded by 11.5 % during the third quarter and fears of monetary tightening spread quickly. This market has been on a path of its own and it has been oblivious to fluctuations in the US market. It is only fitting that this pullback did not affect our market. Additionally, I see robust economic growth as a positive, not a negative.

Companies that do business overseas like Black & Decker benefited from global strength. International sales increased enough to offset domestic weakness and the company beat its estimates. That theme is recurring and now that we are gaining a broader earnings perspective on all of the sectors, the market is stabilizing.

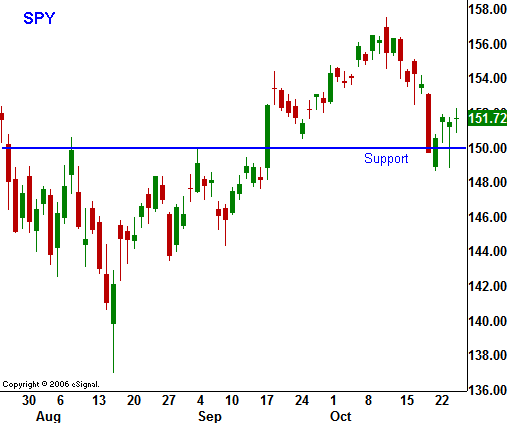

In the chart you can see that the SPY 150 level was breached yesterday on an intraday basis and the market was able to recover. I still believe that there will be a few ugly days between now and the end of the month. Once the dust settles, the market should be able to generate a year-end rally.

Next week, the FOMC will decide if another .25% rate cut is warranted. I don't believe that the decision, one way or the other, will have the impact as we saw last month. If the Fed does not lower rates, the market may be satisfied with the dramatic action that has already been taken. It is also likely that the Fed will suggest that another rate cut is possible if conditions continued to weaken.

Today, durable goods orders declined 1.7%. However, if you strip out defense spending, they rose .7%.

After the close, Microsoft reports earnings and I am expecting an in line number. The rest of the earnings releases after the close and before tomorrow's open look a little weak.

Energy stocks have pulled back over the last week and they rebounded yesterday. I still think it is a little too early to get long this market. Evaluate yesterday's price action to find strong stocks. They are easy to spot during reversal days. They would have held up well during the early part of the day when the market was down and they would have jumped higher as the market rebounded. You will want to get long the stocks if a year-end rally materializes.

Look for choppy, directionless trading today. It is likely that the daily range has already been established.

Daily Bulletin Continues...