Stock Option Trading Strategy – Bull Put Spreads and Long Energy Stock Call Options.

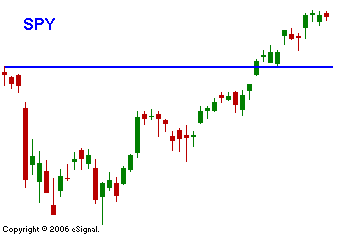

The market has gotten off to a very slow start. Some of the Asian markets were closed for holiday. Tomorrow many European markets will be closed for holiday. This will create a very light volume trading environment. Today, the market has already stayed within a very narrow trading range. There will be many earnings highlights this week but in comparison to last week, they are rather subdued. The big economic number for the week will be the Unemployment Report. If the number mirrors last week's GDP and we see a rise in unemployment and a rise in wage inflation, the market might pull back. It has been able to shrug off all negative news up to this point. However, with the recent run-up and with the traditional May weakness, traders may get nervous. There is still a very strong bid to the market and with the strong earnings releases I believe any pullback will be temporary. I will wait to see how the SPY holds the recent breakout level. Until then my option trading strategy is to sell bull put spreads and to hold my long call positions in energy stocks. Expect quiet trading today. The intraday highs and lows might already be in.

Daily Bulletin Continues...