Stock Option Trading Strategy – Get long energy, but keep it small.

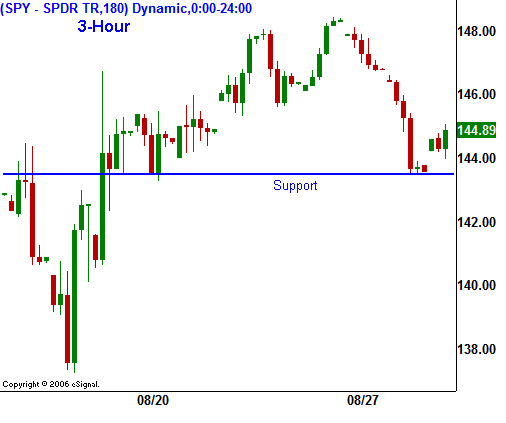

As we saw yesterday, things can get pretty ugly when the bid to the market disappears. Overseas weakness, dismal consumer confidence and hawkish interpretations from the FOMC minutes pressured the market. Now that earnings season has ended, all eyes will be on interest rates.

.

.

CEOs from the mortgage and auto industries are begging for a rate cut. Many analysts feel that a half point interest rate reduction might ward off a recession. The consensus seems to be that the Fed will lower rates by a quarter of a point in September. Personally, I believe that the Fed will stand pat. They have already changed their bias from a rate hike to neutral. The economic numbers that have been coming in are decent. The unemployment rate is very low and this economic blip will eventually correct itself.

Excess liquidity created loose money and the Fed is partially to blame. The last thing they are going to do is to compound that problem by lowering rates. Home prices have rocketed 25% in recent years and now they are down 4% on average. I don't see why everyone is hitting the panic button. A normal correction is overdue. The stock market is within striking distance of an all-time high, yet you would think that it is tanking based on the comments from some analysts.

The Fed lowered interest rates after 9/11 to stimulate the economy. At the same time, President Bush lowered the tax rates. Both of these actions fueled our economy and it overheated. Consumers have been spending more than they make and we now have 27 consecutive months of a negative savings rate. We need to tighten our belts even if it means that the economy will slip.

This country can't continue to borrow against its future at record rates. China and Saudi Arabia are already diversifying away from the dollar. They are uncomfortable with the risk. I feel that Chairman Bernanke senses this and he feels that higher interest rates will keep the economy from overheating again. After all, long-term interest rates are still low relative to their 50 year range.

This all means that the Fed will not give the market what it wants. I think the initial reaction will be a sell off. Once the dust settles, the market will realize that the Fed sees good economic growth and it will rally.

Today's comments are fundamental in nature and they are forward-looking. I don't really see the benefit of trying to predict price movement in this light holiday trading environment. If I had to take a guess, I would expect the current rally to continue with the help of end of month fund buying. Yesterday sell off was overdone. I would keep positions small this week. Energy is the best place to put your money right now.

.

CEOs from the mortgage and auto industries are begging for a rate cut. Many analysts feel that a half point interest rate reduction might ward off a recession. The consensus seems to be that the Fed will lower rates by a quarter of a point in September. Personally, I believe that the Fed will stand pat. They have already changed their bias from a rate hike to neutral. The economic numbers that have been coming in are decent. The unemployment rate is very low and this economic blip will eventually correct itself.

Excess liquidity created loose money and the Fed is partially to blame. The last thing they are going to do is to compound that problem by lowering rates. Home prices have rocketed 25% in recent years and now they are down 4% on average. I don't see why everyone is hitting the panic button. A normal correction is overdue. The stock market is within striking distance of an all-time high, yet you would think that it is tanking based on the comments from some analysts.

The Fed lowered interest rates after 9/11 to stimulate the economy. At the same time, President Bush lowered the tax rates. Both of these actions fueled our economy and it overheated. Consumers have been spending more than they make and we now have 27 consecutive months of a negative savings rate. We need to tighten our belts even if it means that the economy will slip.

This country can't continue to borrow against its future at record rates. China and Saudi Arabia are already diversifying away from the dollar. They are uncomfortable with the risk. I feel that Chairman Bernanke senses this and he feels that higher interest rates will keep the economy from overheating again. After all, long-term interest rates are still low relative to their 50 year range.

This all means that the Fed will not give the market what it wants. I think the initial reaction will be a sell off. Once the dust settles, the market will realize that the Fed sees good economic growth and it will rally.

Today's comments are fundamental in nature and they are forward-looking. I don't really see the benefit of trying to predict price movement in this light holiday trading environment. If I had to take a guess, I would expect the current rally to continue with the help of end of month fund buying. Yesterday sell off was overdone. I would keep positions small this week. Energy is the best place to put your money right now.

.

CEOs from the mortgage and auto industries are begging for a rate cut. Many analysts feel that a half point interest rate reduction might ward off a recession. The consensus seems to be that the Fed will lower rates by a quarter of a point in September. Personally, I believe that the Fed will stand pat. They have already changed their bias from a rate hike to neutral. The economic numbers that have been coming in are decent. The unemployment rate is very low and this economic blip will eventually correct itself.

Excess liquidity created loose money and the Fed is partially to blame. The last thing they are going to do is to compound that problem by lowering rates. Home prices have rocketed 25% in recent years and now they are down 4% on average. I don't see why everyone is hitting the panic button. A normal correction is overdue. The stock market is within striking distance of an all-time high, yet you would think that it is tanking based on the comments from some analysts.

The Fed lowered interest rates after 9/11 to stimulate the economy. At the same time, President Bush lowered the tax rates. Both of these actions fueled our economy and it overheated. Consumers have been spending more than they make and we now have 27 consecutive months of a negative savings rate. We need to tighten our belts even if it means that the economy will slip.

This country can't continue to borrow against its future at record rates. China and Saudi Arabia are already diversifying away from the dollar. They are uncomfortable with the risk. I feel that Chairman Bernanke senses this and he feels that higher interest rates will keep the economy from overheating again. After all, long-term interest rates are still low relative to their 50 year range.

This all means that the Fed will not give the market what it wants. I think the initial reaction will be a sell off. Once the dust settles, the market will realize that the Fed sees good economic growth and it will rally.

Today's comments are fundamental in nature and they are forward-looking. I don't really see the benefit of trying to predict price movement in this light holiday trading environment. If I had to take a guess, I would expect the current rally to continue with the help of end of month fund buying. Yesterday sell off was overdone. I would keep positions small this week. Energy is the best place to put your money right now.

.

CEOs from the mortgage and auto industries are begging for a rate cut. Many analysts feel that a half point interest rate reduction might ward off a recession. The consensus seems to be that the Fed will lower rates by a quarter of a point in September. Personally, I believe that the Fed will stand pat. They have already changed their bias from a rate hike to neutral. The economic numbers that have been coming in are decent. The unemployment rate is very low and this economic blip will eventually correct itself.

Excess liquidity created loose money and the Fed is partially to blame. The last thing they are going to do is to compound that problem by lowering rates. Home prices have rocketed 25% in recent years and now they are down 4% on average. I don't see why everyone is hitting the panic button. A normal correction is overdue. The stock market is within striking distance of an all-time high, yet you would think that it is tanking based on the comments from some analysts.

The Fed lowered interest rates after 9/11 to stimulate the economy. At the same time, President Bush lowered the tax rates. Both of these actions fueled our economy and it overheated. Consumers have been spending more than they make and we now have 27 consecutive months of a negative savings rate. We need to tighten our belts even if it means that the economy will slip.

This country can't continue to borrow against its future at record rates. China and Saudi Arabia are already diversifying away from the dollar. They are uncomfortable with the risk. I feel that Chairman Bernanke senses this and he feels that higher interest rates will keep the economy from overheating again. After all, long-term interest rates are still low relative to their 50 year range.

This all means that the Fed will not give the market what it wants. I think the initial reaction will be a sell off. Once the dust settles, the market will realize that the Fed sees good economic growth and it will rally.

Today's comments are fundamental in nature and they are forward-looking. I don't really see the benefit of trying to predict price movement in this light holiday trading environment. If I had to take a guess, I would expect the current rally to continue with the help of end of month fund buying. Yesterday sell off was overdone. I would keep positions small this week. Energy is the best place to put your money right now.Daily Bulletin Continues...