Stock Option Trading Strategy – Short retail and restaurant bearish call spreads.

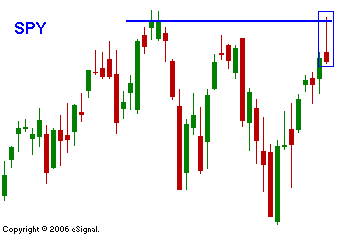

“When the men are away, the mice will play." Last week the market staged a nice rally during a holiday shortened week. I am not prepared to completely discount last week’s move, but I do know that institutions can manipulate prices when liquidity dries up. Last Friday I witnessed a classic example of this. I brought up my scans and many of the dollar gainers for the day were "dogs" that were rallying from an oversold condition. Those stocks still have relative weakness and it was a blatant attempt at a short squeeze. The retail sector has been very weak and in the last week of June, same store sales were only up 1.2%. Yet, these stocks posted huge gains on Friday ahead of the retail sales figures this week. Today, those same stocks are trading lower. In the chart you can see that the market opened on a high note. It took its lead from the global markets, Asia in particular. That market touched the all-time high and it quickly backed off. The resulting candlestick pattern is known as a shooting star. The day is young and perhaps this formation will change. For the time being it is short-term bearish. Even with a positive backdrop (global markets trading higher and oil trading lower) the market made a half-hearted attempt at a new high. The economic calendar is light this week and the new earnings season will kick off after the close with AA. This week’s highlight will be GE since the company operates across most industries and it has a global presence. It is really the only company worth mention this week and I am expecting solid results. The big announcements will kick in next week. The market is within striking distance of a new high. I believe it will take a solid round of earnings to create a breakout. This week, the market might pull back, establish a bid and rally from that level next week on positive earnings results. I will try to buy a dip this week and I will be focusing on energy, heavy equipment, mining and agricultural stocks. For now, I am still short retail and restaurant call credit spreads. They gave me a little bit of excitement last week, but now those stocks are heading lower and giving me some breathing room with only two weeks left until expiration.

Daily Bulletin Continues...