Stock option Trading Strategy – Sell put credit spreads on commodities stocks.

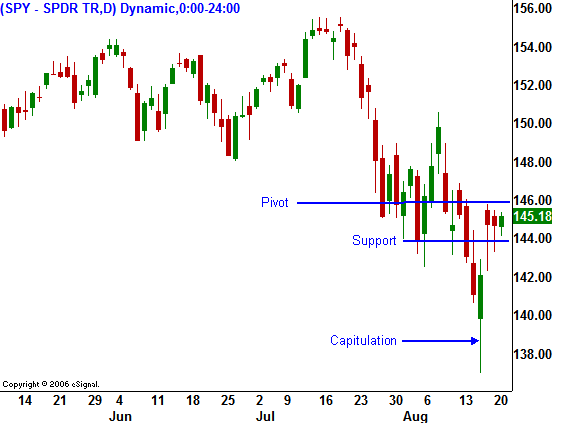

Yesterday, the market started off flat and by mid-morning the downside was tested. The sell-off was rather orderly as opposed to the sharp drops and air pockets we have seen recently. Once the lows were established, the market fell into a fairly tight trading range. When the bears were unable to push prices lower, buyers stepped in and rallied the market back to unchanged in the last two hours of trading. This marks the third day in a row where buyers have taken command during the last hour of trading. That is a bullish sign. My bullish bias increases every day the market avoids another round of selling. The shorts remember the nasty snap back rally in March and they are prepared to take profits if the SPY is able to rally above 146.

This morning, retailers released earnings and they were in line with lowered expectations. The bad news was already priced in and many of the stocks are trading higher. I believe we will continue to see this unfold as other retailers announce earnings this week.

The credit squeeze is now gaining political traction and every elected official is voicing their opinion. There is a tremendous amount of pressure on the Fed to do the “right thing”. They have wisely softened their rhetoric.

Think back a few months ago when you heard about all of the liquidity in the market place. There was more money than opportunity and large investors were looking hard for places to invest their capital. The credit picture has tightened in recent weeks; however there is still plenty of money that will find its way into sound investments. The recent sell-off in commercial paper will soon find buyers that feel the rewards outweigh the risk. Warren Buffet today announced that he is looking to buy some of CFC’s assets.

The market will be relatively quiet today and there is a chance for a small rally. I believe the SPY will rally above 146 this week and we will see a nice round of end-pf-the-month buying next week. I am currently selling put credit spreads in commodities stocks. I feel that the unwinding of the yen-carry trade temporarily pushed these stocks down. The macro business conditions remained sound for these companies and they trade at very low valuations.

Daily Bulletin Continues...