Friday’s Stock Option Trading Strategy!

There could be a nice option trading opportunity today. Watch for a reversal and buy call stock options if it happens.

This week the Fed gave the market what it wanted, a .25% rate cut. It also lowered the discount window rate. The initial reaction was positive and the market rallied. After thinking about it overnight, traders did not like the fact that the rate cut safety net had been removed. In its comments, the Fed made it known that another rate cut should not be expected.

Yesterday, the market sold off on concerns that the economy is weak and that additional subprime write offs could continue to plague financial stocks. Before the open today, the Unemployment Report showed an increase of 160,000 jobs. That was considerably better than expected. The market tried to rally on the news, but it quickly reversed as financial stocks got nailed once again. There continue to be rumors about massive write-downs that will jeopardize the "fat" dividends paid by financial firms.

I did not expect a negative reaction to the news this week. If you ask me to guess how the market would react to a quarter-point rate cut, a strong employment number and inflation that is within the Fed’s target range, I would have bet on a big rally. Rumors continue to swirl and no one knows the extent of the damage, not even the financial firms themselves. It is almost impossible to "mark" positions when there is not a market for the assets.

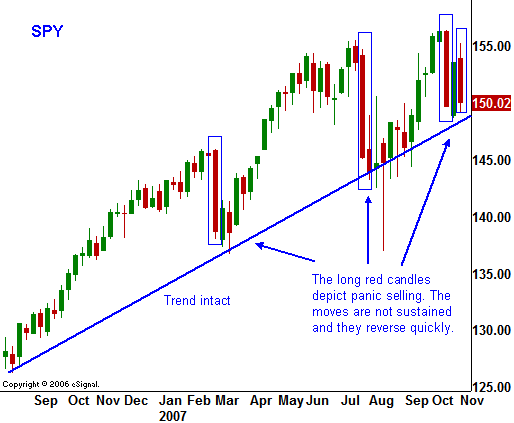

Stocks have a tendency to overextend themselves in both directions and in this case I believe the financial stocks are oversold. With each new low, they are compressing like a spring. Eventually, when a support level has been found, they will jump higher. That support level has not been found yet and I would avoid these stocks. The significance of this observation is that financial stocks comprise 20% of the S&P 500. When the lows are established, this sector will stop weighing on the market.

The US is the weakest link in the global economic chain. Companies that do 50% of their business overseas are reaping record profits. The economic numbers have been strong and I agree with the Fed's policy during this meeting. The soft patch will work its way through our economy.

For today, I see the potential for a reversal. If the market rallies back and is unchanged in the last hour of trading, get long. If the market stays in negative territory, wait for support next week. Tech and commodity stocks are the safest plays.

Daily Bulletin Continues...