Stock Option Trading Strategy – Reduce long positions and add short positions.

I have been bullish on the economy and today's unemployment number has tainted my bias. I did not expect the dramatic decline this month and I certainly don't believe that anyone saw the huge revisions for June and July. For the month of August, analysts were expecting 115,000 new jobs. The actual number showed a decrease of 4000 jobs. That is a whopping 120,000 miss. June and July numbers were reduced by about 50,000 in each month.

Extremely high consumer debt levels (and I'm not just talking subprime mortgages) will haunt the strength of this economy if people start getting laid off.

This week, the Fed invited major homebuilders to share their perspective on the economy. I'm sure they got an earful. A rate cut is almost certain after this dismal employment report. Inflation is in check and now the Fed can ease rates and not look like they are doing so to bail out companies that made poor lending decisions.

Next week is very light on the economic and earnings front. I believe this piece of information will feed the action throughout next week. Since the number was so weak, I believe the market will continue to drift lower until the FOMC. Now traders will be trying to determine if the Fed is going to do a ¼ or ½ point cut.

If the Fed lowers the rate ¼ point before the FOMC, it might be viewed as a progressive move and that might be enough to satisfy the market. On the other hand, a ¼ point cut during the FOMC will not carry the same urgency. In that case, the market may decline on anything less than a ½ point cut.

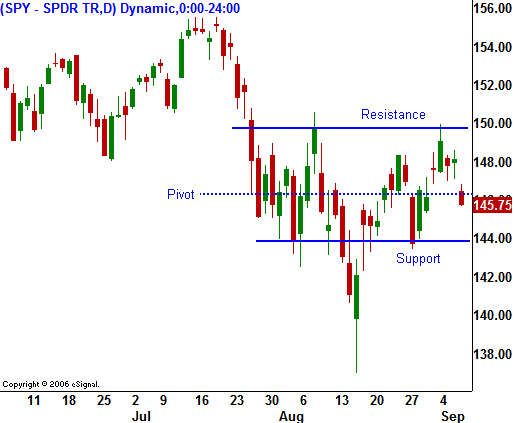

The momentum is down and I doubt anyone will want to go home long. The SPY has breached the critical 146 level. I believe you can short any rally this afternoon. It's time to reduce your longs and add a few shorts.

Daily Bulletin Continues...