Stock Option Trading Strategy -Bull put spreads and long calls on energy stocks.

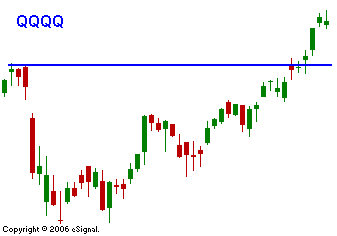

The market has made a major move up this week. Today it is simply taking a breather. Normally, the economic releases from this morning would be very bearish. The GDP came in weaker than expected and it showed a 1.3% increase in the first quarter when 1.7% was expected. This was the weakest rate of expansion in four years. To make matters worse the GDP Price Index increased 4%, the most in 16 years. This release yielded the worst possible combination; a slower economy and rising prices. The bullish market action has kept most analysts from uttering the word stagflation. The market has been able to contain the losses so far today and I don't believe the bears will go into the weekend short. Even a foiled terrorist plot against oil fields in Saudi Arabia and a US dollar that is near 30 year lows have not been able to garner selling pressure. This is a time to be cautious. The market has made a nice gains this month and with May approaching, it is possible that we may see some profit taking. I would like to see a test of QQQQ 45.50. If that level holds it will present a nice buying opportunity. My option trading strategy still favors bull put spreads and I have purchased calls on a handful of energy stocks. I believe the market will be range bound today and the intra-day highs and lows are likely to hold.

Daily Bulletin Continues...