FOMC Stock Option Trading Strategy!

Buy commodity stock call options ahead of the Fed. Once the news is released, option trading will go into fast market conditions and it will be tought to get a good fill.

Yesterday, the market pulled back ahead of the Fed announcement. Today, it has recouped those losses on the notion that we will get a .25% rate cut. The new Fed regime has given the market what it wants so far and there is no reason to think that they will disappoint today.

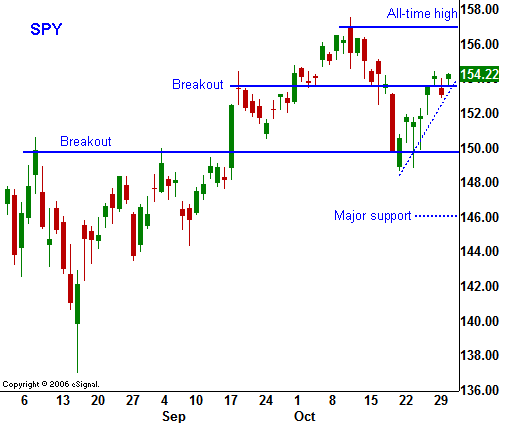

If we do get the rate cut, there is a good chance that the market will rally to a new all-time high. The ADP employment index came out relatively strong and if the same holds true for the Unemployment Report this Friday, the market will add to the breakout.

The earnings have been coming in solid and we have not seen a material decrease in earnings guidance. I believe you have to get long ahead of the Fed. The best way to play it is to be long commodity stocks. They are extremely strong today and they will lead the market higher. If by chance the Fed does not lower rates, these stocks should hold up relatively well and give you a chance to exit the trade without losing much money.

The path of least resistance is up and there are many positive influences on the market. Low unemployment, contained inflation, solid earnings growth (outside of the financials and housing sector), low interest rates, very bullish seasonality, and global expansion all add up to a positive bias.

If the market pulls back, I would wait for support and then I would get long. That would be the best case scenario, since it would give you an excellent entry price.

While the economic conditions might be changing in the US, I do not believe they will deteriorate substantially before year-end.

Daily Bulletin Continues...