Stock Option Trading Strategy – Sell out-of-the-money bull put spreads on low P/E global stocks.

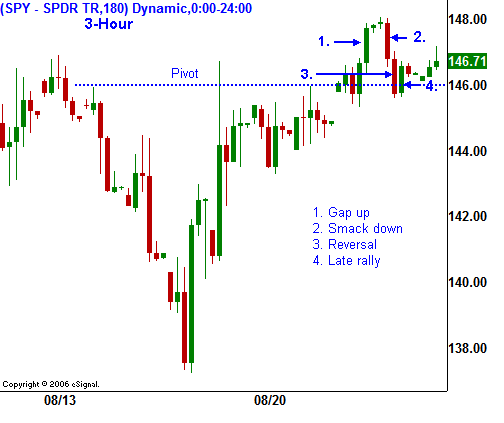

Yesterday's price action was very telling. The market had posted five consecutive late day rallies and it received a dose of great news after Wednesday's close. Thursday morning, the market gapped higher on news that Bank of America was making a large investment in Countrywide Financial. The S&P 500 futures gapped 10 points higher on the news.

As the market prepared to open Thursday morning, those gains started to deteriorate. Soon after the normal trading hours started, the futures fell back to unchanged. At that juncture it was difficult to determine if the market had reached a resistance level, or if traders simply felt that the news did not justify the reaction. The momentum from the early reversal paved the way for bears to maintain selling pressure and they were able to push prices lower. By late afternoon, the market was able to stage another rally and finish unchanged for the day. The SPY 146 level was preserved.

This price action shows that buyers are willing to step up and buy stocks. It also demonstrates that we are not going to have a melt up rally. A great deal of nervousness still exists and any rally will be hard-fought.

.

.

This morning, strong durable goods orders have created a bid to the market. That positive economic news was complimented by new home sales that came in better than expected.

At this juncture, the market looks like it has avoided a sell off yesterday and I believe it will grind higher today. Next week there are many economic numbers that will be released. Barring any additional sub-prime defaults, I believe the economic numbers will show stability and they will pave the way for a continued market bounce. As we move above SPY 146, greater pressure will be placed on the shorts to cover. Next week, the market should also gain strength from end-of-month buying.

Traders are trying to squeeze in a vacation and the activity today will be light. I still like keeping my distance by selling put credit spreads on stocks that have relatively low P/E ratios and generate 50% of their revenues overseas.

.

This morning, strong durable goods orders have created a bid to the market. That positive economic news was complimented by new home sales that came in better than expected.

At this juncture, the market looks like it has avoided a sell off yesterday and I believe it will grind higher today. Next week there are many economic numbers that will be released. Barring any additional sub-prime defaults, I believe the economic numbers will show stability and they will pave the way for a continued market bounce. As we move above SPY 146, greater pressure will be placed on the shorts to cover. Next week, the market should also gain strength from end-of-month buying.

Traders are trying to squeeze in a vacation and the activity today will be light. I still like keeping my distance by selling put credit spreads on stocks that have relatively low P/E ratios and generate 50% of their revenues overseas.

.

This morning, strong durable goods orders have created a bid to the market. That positive economic news was complimented by new home sales that came in better than expected.

At this juncture, the market looks like it has avoided a sell off yesterday and I believe it will grind higher today. Next week there are many economic numbers that will be released. Barring any additional sub-prime defaults, I believe the economic numbers will show stability and they will pave the way for a continued market bounce. As we move above SPY 146, greater pressure will be placed on the shorts to cover. Next week, the market should also gain strength from end-of-month buying.

Traders are trying to squeeze in a vacation and the activity today will be light. I still like keeping my distance by selling put credit spreads on stocks that have relatively low P/E ratios and generate 50% of their revenues overseas.

.

This morning, strong durable goods orders have created a bid to the market. That positive economic news was complimented by new home sales that came in better than expected.

At this juncture, the market looks like it has avoided a sell off yesterday and I believe it will grind higher today. Next week there are many economic numbers that will be released. Barring any additional sub-prime defaults, I believe the economic numbers will show stability and they will pave the way for a continued market bounce. As we move above SPY 146, greater pressure will be placed on the shorts to cover. Next week, the market should also gain strength from end-of-month buying.

Traders are trying to squeeze in a vacation and the activity today will be light. I still like keeping my distance by selling put credit spreads on stocks that have relatively low P/E ratios and generate 50% of their revenues overseas.Daily Bulletin Continues...