Stock Option Trading Strategy – Keep your powder dry and trade the breakout or breakdown Tuesday.

Today the market is weaker due to worries that the credit squeeze has spread to Europe. Over the weekend, a British lender is faced with liquidity issues. Traders that thought this problem was isolated to the US are now having second thoughts.

Alan Greenspan has been busy commenting on the economy. His statements spell stagflation. He is concerned about the depth of the housing bubble and he sees inflationary pressures ahead.

Tomorrow marks one of the most important trading days of the year. Before the open, the PPI and LEH earnings will be released. If the PPI comes in "hot", you can expect to hear comments about it and the FOMC’s statements. They already know where the number will come out and the rhetoric is built into their release. I believe they will reluctantly lower interest rates by .25% and state that inflation continues to be a concern. The market will react negatively since it wants to hear that another rate cut is right around the corner. As for LEH earnings, I believe poor results are baked into the stock price. A miss could rally the stock if the guidance is encouraging.

The Fed’s actions are already factored into the market. It is the rhetoric that will be scrutinized. They never want to tip their hand and the comments are likely to be very hedged. They will acknowledge the housing bubble and the possibility of economic weakness and they will voice their concern over rising prices.

The market’s reaction Wednesday will be more telling. Traders will have digested the news overnight and we will be able to see if the initial move Tuesday has legs. Thursday's earnings releases from GS and BSC will be very important as well. This is our chance to gauge the earnings impact from the liquidity crunch and housing bubble.

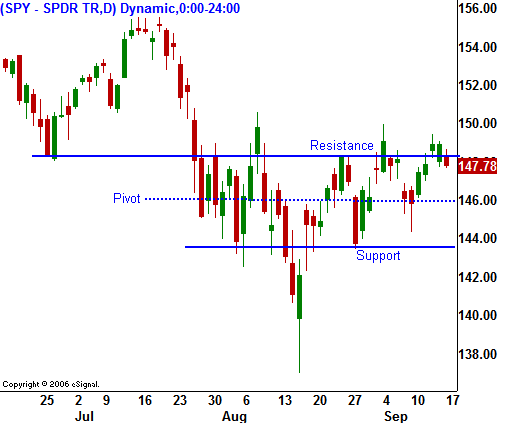

Once the market momentum favors a direction, I expect quadruple witching program trading to accelerate the move. In today's chart I have outlined the support and resistance levels. I recommend being flat by the close of trading Monday. Take a close look at the PPI and LEH earnings tomorrow. Make a list of your best longs and shorts and be ready to trade a breakout or a breakdown tomorrow afternoon. As I outlined in my special report, use conditional orders to enter the trades in advance of the FOMC release. Once the fireworks start, it will be too late to try and enter orders.

Daily Bulletin Continues...