Stock Option Trading Strategy – Close the retail stock call credit psreads.

After a wild two-week party, the lights are on and the aftermath is ugly as everyone takes a look around. The hangover has set-in and there is a lack of activity.

For quite some time I have been pointing out the expanded daily ranges. When I compared the recent daily trading ranges to the ranges seen during the last few months, the disparity was obvious. Increased volatility is normally a precursor to a large move.

In this case the move was down. The sub-prime woes created a short-term liquidity squeeze. That event had a cascading effect and it spread into other areas. Last week, it culminated when brokerage firms raised margin requirements and hedge funds that use leverage were forced to liquidate positions. The move was exacerbated by option expiration sell programs. Thursday’s huge intraday reversal finally brought out some buyers. Then, Friday’s Fed action helped stabilize credit markets and the market rallied on the news.

Today, the market survived the weekend and that is significant. Overseas markets rallied in response to our rally last Friday. The market has now staged back to back late day rallies.

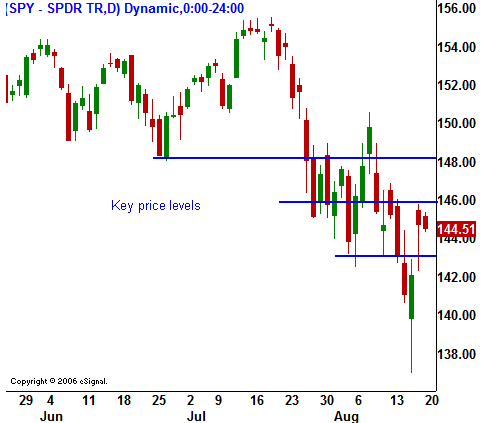

The economic releases this week are light. The earnings releases include many retailers. I believe most of the bad news has been factored in to retail stocks. Consequently, I believe that there’s a good chance for upside earnings reactions. We are not out of the woods yet, but I believe a close above SPY146 would force some shorts to cover. That is a key horizontal price level since it represents the breakout from last April.

.

.

I still like many of the cyclical stocks that generate international revenues and trade at relatively low P/E ratios. I am buying in my retail call credit spreads. This weekend I reviewed the price action for many of the retailers and during last week’s blood bath and these stocks actually held up fairly well. I believe all of the bad news is priced in and I don’t want to be short these stocks going into the holiday season.

Today I expect the market to be very quiet and once again I’ll be watching the price action during the last hour of trading. I believe there is a better chance for a small rally than a small sell off.

.

I still like many of the cyclical stocks that generate international revenues and trade at relatively low P/E ratios. I am buying in my retail call credit spreads. This weekend I reviewed the price action for many of the retailers and during last week’s blood bath and these stocks actually held up fairly well. I believe all of the bad news is priced in and I don’t want to be short these stocks going into the holiday season.

Today I expect the market to be very quiet and once again I’ll be watching the price action during the last hour of trading. I believe there is a better chance for a small rally than a small sell off.

.

I still like many of the cyclical stocks that generate international revenues and trade at relatively low P/E ratios. I am buying in my retail call credit spreads. This weekend I reviewed the price action for many of the retailers and during last week’s blood bath and these stocks actually held up fairly well. I believe all of the bad news is priced in and I don’t want to be short these stocks going into the holiday season.

Today I expect the market to be very quiet and once again I’ll be watching the price action during the last hour of trading. I believe there is a better chance for a small rally than a small sell off.

.

I still like many of the cyclical stocks that generate international revenues and trade at relatively low P/E ratios. I am buying in my retail call credit spreads. This weekend I reviewed the price action for many of the retailers and during last week’s blood bath and these stocks actually held up fairly well. I believe all of the bad news is priced in and I don’t want to be short these stocks going into the holiday season.

Today I expect the market to be very quiet and once again I’ll be watching the price action during the last hour of trading. I believe there is a better chance for a small rally than a small sell off.Daily Bulletin Continues...