Thursday’s Stock Option Trading Strategy!

The tock market is likely to grind higher today. Your option trading should focus on out of the money credit spread strategies.

The market always keeps traders humble. In time, you learn to expect the unexpected because you know that you are never any control of the situation. All you can do is to "pick your points" and roll with the punches.

I find that I spend 80% of my time trying to position myself correctly. Trades are established and risk is adjusted. Those periods only yield average results. About 20% of the time, I'm in the right place at the right time with the right stock. That’s when I make the majority of my money.

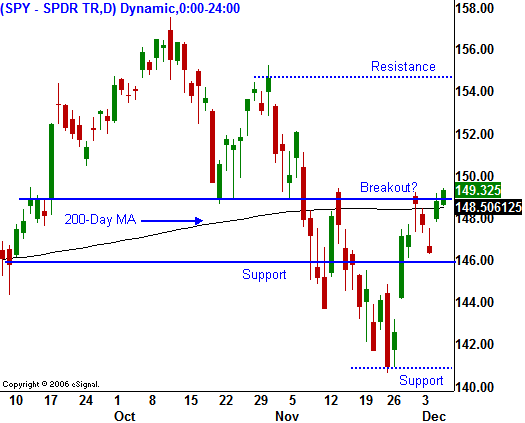

After the quarter point rate reduction in October, the market was within striking distance of a new all-time high. I thought that year-end strength, decent earnings, solid economic reports (at the time) and lower interest rates would fuel the market to new highs. We all know that didn't happen.

The market reversed sharply and it corrected by 10% before it established support. When you’ve been burned, it's hard to get that bad taste out of your mouth. Often, your perspective is clouded and your bias is affected by outside influences. It is important to remain objective. These are some of the most challenging times a trader will face.

I used to really punish myself during these periods, but now I've learned to take them in stride. The key is to identify what went wrong in your analysis and to determine if changing market conditions were to blame. It is also important to trade smaller size and to gradually build back your account.

On the eve of the Unemployment Report I thought that some of you might benefit from this insight.

From my standpoint, conditions have changed. I thought that the Fed was catering to the financial community when it aggressively lowered rates by a half point two months ago. The data now reflects deterioration in economic activity.

Today, retail sales were released. According to Thomson Financial, 4 merchants exceeded expectations and 15 missed. Yesterday, Fannie Mae cut its dividend and today MBIA said it may not have enough capital to maintain its credit rating because of potential mortgage related losses. Last week’s GDP number looked good on the surface, but an inventory buildup masked the true weakness. The durable goods number also looked good, but a 16% increase in defense spending concealed the decline.

There are many indications that the economy is slowing down. The Fed is concerned and they are being accommodative. The Treasury Department has also done its fair share by establishing a "mortgage reset freeze" program. The bottom line is this; the market is addicted to easing policies.

In the last few months, every time bad news hit the wires, the market instantly looked to the Fed. It rallied into the event and everyone was happy for a brief moment. The "high" quickly wore off and the market started wondering where its next fix was going to come from. At the current pace, the Fed will quickly run out of bullets.

As I mentioned before, I got caught during the recent market decline. I started to reevaluate my decision-making and I realized that conditions have changed. I did not capitalize on the recent rally and I wanted to make sure that my perspective was clear before I ramped up my trading.

I believe my analysis is correct and I'm not being influenced by "sour grapes". This market has some serious issues that need to be resolved and I believe the existing highs will remain intact. Year-end bullishness could challenge those levels, but not in a sustained/meaningful way.

Tuesday’s ADP Employment Index and today's jobless claims number suggest that tomorrow's Unemployment Report will be decent. If the FOMC announces a quarter point rate cut next week, the market could rally to the old highs. However, I believe that the euphoria will be short-lived and the market will pullback.

I remain skeptical of this rally and I have not ramped up my trading.

For today, the market has been able to get through SPY 149 resistance and it looks like the rally will continue the rest of the day. Traders will be cautious ahead of a big number tomorrow and I'm not expecting a huge rally. I still believe that out of the money put spreads and out of the money call spreads are the way to play relative strength and weakness. You can be on the wrong side of the market, but in the right stock and still make money if you distance yourself from the action. The high option implied volatilities are providing a nice cushion as well.

Daily Bulletin Continues...