Monday’s Stock Option Trading Strategy!

Short-term bearish option trading opportunities exist today. The better play - wait and buy call stock option on commodity stocks once the market finds support.

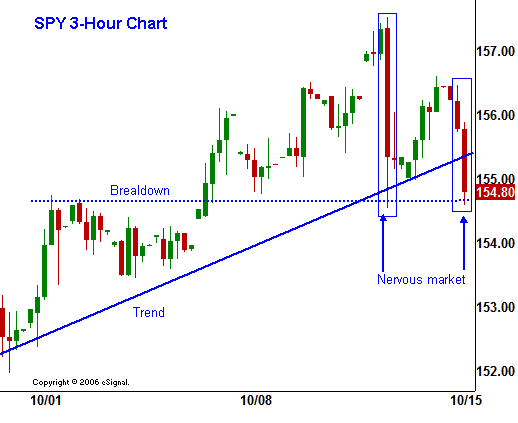

Last Thursday the market rallied to new highs on better than expected economic news. That rally was toppled by hawkish statements from a Fed Official and by the end of the day we were in a full-blown reversal. Friday, the market staged a nice bounce and the market rallied throughout most of the day.

This morning the market is once again trying the downside and it looks like traders are nervous going into this week's earnings. Many national and regional banks will be announcing earnings this week. Over the last few weeks they have been preparing the market for the write-downs that will be reported. The market has been able to take that news in stride. However, now that the actual impact is hitting the bottom line, investors are uneasy.

Major earnings are going to be released over the next few days and that will drive the market. Today’s selling feels like it could continue. The momentum has been strong and buyers are pulling their bids. In the last 8 months we have seen days where the buying dries up and the prices plunge. After a few days/weeks, prices stabilize.

Take some profits and look for better re-entry points for commodities stocks. This is the strongest sector. It could fall sharply as speculators bail, but it will be the first to come back.

Daily Bulletin Continues...