Stock Option Trading Strategy – Sell bull put spreads on international cyclical stocks.

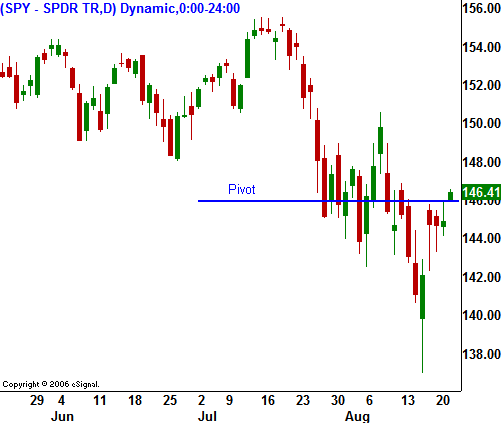

Yesterday the market had a nice, quiet day. In the past few weeks, traders have sold into every financial stock rally. That changed yesterday and it looks like the short-term lows might be in for that sector. In order for this market to have a sustained rally financial stocks must participate. They represent 20% of the S&P 500. Commodity stocks and cyclicals have rebounded nicely. I mentioned that the market was likely to trade above SPY 146 this week. That is a critical price level and it should force some shorts to cover.

.

.

The market opened on a very solid note today. Foreign markets rallied overnight and the market had a positive reaction to retail earnings. Barring any additional lending casualties, the market should continue to rally this week. There are rumblings that some of the sub-prime lenders are finding investment interest from deep pockets. I believe the market will be able to hold its early gains and it will grind higher into the close. I still like selling put credit spreads on cyclical stocks and commodities stocks. Yesterday I mentioned selling put spreads on commodity stocks and in one day that strategy has paid off nicely.

.

The market opened on a very solid note today. Foreign markets rallied overnight and the market had a positive reaction to retail earnings. Barring any additional lending casualties, the market should continue to rally this week. There are rumblings that some of the sub-prime lenders are finding investment interest from deep pockets. I believe the market will be able to hold its early gains and it will grind higher into the close. I still like selling put credit spreads on cyclical stocks and commodities stocks. Yesterday I mentioned selling put spreads on commodity stocks and in one day that strategy has paid off nicely.

.

The market opened on a very solid note today. Foreign markets rallied overnight and the market had a positive reaction to retail earnings. Barring any additional lending casualties, the market should continue to rally this week. There are rumblings that some of the sub-prime lenders are finding investment interest from deep pockets. I believe the market will be able to hold its early gains and it will grind higher into the close. I still like selling put credit spreads on cyclical stocks and commodities stocks. Yesterday I mentioned selling put spreads on commodity stocks and in one day that strategy has paid off nicely.

.

The market opened on a very solid note today. Foreign markets rallied overnight and the market had a positive reaction to retail earnings. Barring any additional lending casualties, the market should continue to rally this week. There are rumblings that some of the sub-prime lenders are finding investment interest from deep pockets. I believe the market will be able to hold its early gains and it will grind higher into the close. I still like selling put credit spreads on cyclical stocks and commodities stocks. Yesterday I mentioned selling put spreads on commodity stocks and in one day that strategy has paid off nicely.Daily Bulletin Continues...