Thursday’s Stock Option Trading Strategy!

Minimize your option trading activity. You can't predict the market direction and stock option premiums are expensive.

What a week. Monday, the market tanked. Tuesday, the market exploded higher. Wednesday, the market started off strong and it reversed to close lower. Today, the market is trading lower even though the economic numbers came in as expected.

The CPI came in at .3% and that was right on with expectations. The Philly Fed rose to 8.2 from 6.8 in October and that shows manufacturing growth. The jobless claims came in a little higher than expected. Overall, these numbers are not responsible for the market decline.

Overnight, news came in on a $2.7 billion write-down from Barclays. That was actually better than expected. GE offered institutional investors $.96 on the dollar if they wanted to redeem holdings in the $5.6 billion GEAM Trust Enhanced Cash Fund. That resulted in a $600 million loss and now GE's pension fund is the sole participant. Additionally, Standard & Poor's lowered the credit rating for BSC to A from A+.

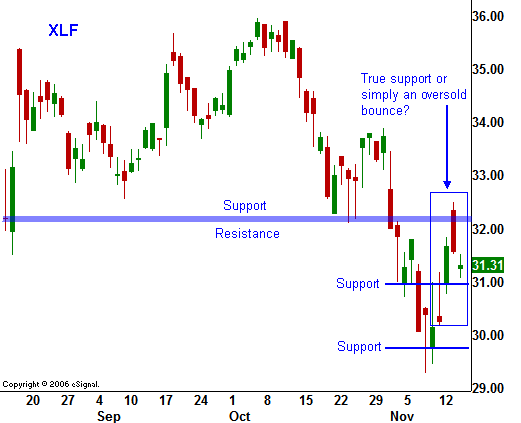

Once again, financial stocks are putting pressure on the market. In the chart you can see the XLF Index. I am using it as a market gauge. If the financials have established true support, the market has a chance for a year-end rally. If the recent XLF rally was an oversold bounce, these stocks could test and breach support. If that scenario unfolds, the market will head lower.

Fear of the unknown is weighing heavy on the market. Investors don't know how the assets at these large financial institutions are being valued. It is possible that a worst-case scenario is already priced in. It is also possible that we have just seen the tip of the iceberg. The pendulum can swing either way at this juncture and that is creating a great deal of volatility.

This is a time to trade very small size. As I have been mentioning, the SPY 146 level is critical. If the market closes below it, go to cash. I do not want to short this market. Wednesday was the type of snap back rally you can get when the market is in a five-year uptrend. If the SPY stays above 146, maintain a handful of long positions. Don’t add to long positions until the market can close above SPY 149. Ideally, financial stocks will confirm that strength by closing above XLF $32.50.

For today, the reversal from yesterday's highs and the follow through this morning lead me to believe that we are in store for a weak day. If SPY 146 fails this afternoon, things could get ugly. Traders are very reluctant to fade the intraday momentum once it has been established. Option expiration is unlikely to be a factor at this stage unless we get a big sell off. If that happens, the downside move could pick up steam. Keep your size small.

Daily Bulletin Continues...