Stock Option Trading Strategy – Short out-of-the-money call spreads on retail and restaurant.

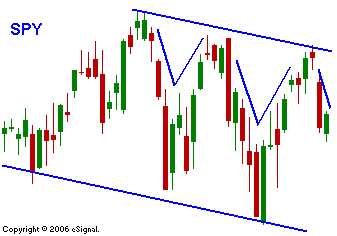

A number of events spooked the market yesterday. Before the open, Moody's announced that it might downgrade its rating for the whole sub-prime lending group. This should not have come as a major surprise. With the dark cloud that hangs over the housing market, this event should have been expected. Next, Home Depot and Sears cast serious concerns over the strength of consumers. Home Depot posted dismal results, however the stock was saved when it announced a major buyback program. Sears did not fare as well and the stock shed $17. The Fed Chairman delivered a prepared speech and his mid-morning comments about inflation were interpreted in a negative way. He did not suggest a change in interest-rate policy. I believe the fact that he was talking about inflation during a skittish market was all it took to get buyers to put their wallet back in their pocket. As we have recently witnessed, once the bids disappear, the market continues its slide and it sells off right into the close. There is an absence of news and the market is trading off of anything it can sink its teeth into. The real fireworks won't start until next week. There is a good chance that the market will rally into expiration. My interpretation of the chart is that resistance is mounting. You can see the downward sloping resistance line and the new relative lows that have been made during a period of expanded volatility. I hesitate to call this a bearish formation because the market has proved time and again that in a matter of days you can rally to new highs and destroy the bears. For now, let's just say that there is a resistance level and that selling out of the money call spreads on relatively weak stocks makes sense. This is a good time to start looking at the earnings calendar ahead. Today I believe the market will continue to rebound from yesterday's decline. The sell off seemed a little overdone. I do not believe that it will make up all of yesterday's losses.

Daily Bulletin Continues...