Thursday’s Stock Option Trading Strategy!

Stock option traders should maintain a "buy the dip" mentality. Bearish option trading has been a losing proposition this year.

As I mentioned yesterday, the positive earnings releases would be overshadowed by the negative earnings releases. Financial stocks continue to weigh on the market. This morning Washington Mutual, E-trade and Bank of America disappointed the market.

Foreign markets were generally down and that also weighed on prices this morning. The market has been able to contain a big slide, but the last hour of trading could change that.

After the close today we will get earnings from GILD, GOOG, ISRG, MHK, SNDK, COF, VFC, XLNX, and ZION. The first three stocks should be positive for the tech sector, however the rest of the stocks on the list have the potential to disappoint.

Tomorrow, before the open, we will hear from MMM, ACI, CAT, FITB, HOG, MCD, SLB, WB and XRX. MMM should produce a solid number. MCD has already pre-announced good results and that news is factored in. The rest of the stocks in the list have the potential to disappoint. I hate to sound pessimistic, but these stocks have been weak relative to the market.

Overall, I would not be surprised to see the market trade lower on earnings news tomorrow morning. I am not bearish; I am just looking at what the most likely outcome is. As I recall, the last three earnings seasons have kicked off with a weak first week and then stocks with greater strength start announcing and the market stabilizes or rallies.

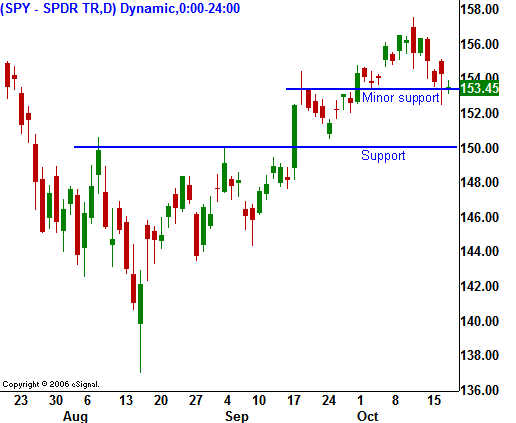

This is a good time to keep your powder relatively dry. I am much more interested in getting long commodity stocks at the SPY 150 level than I am here. Shorting this market has proven to be a losing proposition this year so you have to maintain a "buy the dip" mentality. If you try to get cute and short this market, you face the risk of getting crushed by a snap back rally to new highs.

Wait for an opportunity to buy commodity stocks and tech stocks. If you are compelled to short this market, stick with restaurants and retail.

Daily Bulletin Continues...