Stock Option Trading Strategy – Bull put spreads, long calls on energy stocks.

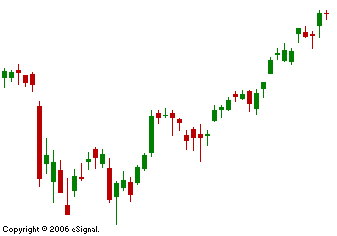

In yesterday's market commentary, I mentioned the possibility of a melt-up and that's exactly what happened. The market tested the downside, and when the bears were unable to push prices lower, the bulls step in and bought everything in sight. The market made another multi-year high on strong volume. This time, tech stocks led the way. This morning we received another dose of solid earnings and the tech stocks are strong again. Half of the companies in the S&P 500 have already reported. The earnings growth rate stands at 6.3% so far. The market seems to be on a steady course higher, and it has been able to shrug off any negative news. I expect prices to continue to grind higher right into Friday's close. The bears will not try to short this market given the strength and the possibility of another leg up on "merger Monday." I do not expect a big move today and I think the price action will be relatively quiet. My current option strategy is to sell bull put spreads. I have recently purchased calls on energy stocks and I believe that they will hold up well, if the market reverses. There are many Asset Managers, who are trying to play catch-up and they don't want to miss this breakout move.

Daily Bulletin Continues...