Stock Option Trading Strategy – Buy global construction and heavy equipment calls before earnings.

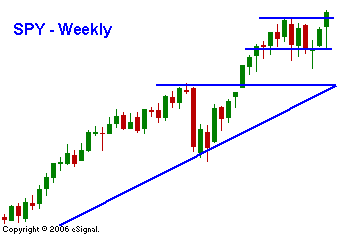

Wow! I've been mentioning that the market is so strong that it can string together weeks of questionable price action and destroy the notion of a pullback in a single day. Early in the day retail sales numbers came out better than expected. That was one of the dark clouds hanging over the market. Rising interest rates and high gasoline prices were expected to put the pinch on consumers. That happened, but the results were not as severe as the market had priced in. I am still bearish on retail and restaurant stocks, but with the market making new all-time highs, I'm not expecting them to drop. My call credit spreads on those stocks are still in good shape despite yesterday's rally. The market staged a bona fide breakout and you need to look for opportunities to get long. Earnings season is approaching and I would stay long heavy equipment and global construction. Today, GE announced earnings and they knocked the cover off the ball in those divisions. Next week there will be many huge earnings announcements and the mega-cap stocks will determine the magnitude of the market’s breakout. We will also gauge inflation when the CPI and PPI numbers are released. I'm expecting a bullish bias to this expiration and there could be many buy programs that fuel this rally. For today, I expect the market to grind higher ahead of "merger Monday" and the above mentioned influences.

Daily Bulletin Continues...