Tuesday’s Stock Option Trading Strategy!

Use SPY 146 as your option trading guide. If the market is above that level, start selling some out of the money put options on stocks you like. If it is below SPY 146, go to cash.

The market is staging a bounce to a very oversold condition. Financials, retail and housing have been pummeled. No one really knows if the worst is over. For now, traders need to assess what is known

Yesterday, the really "good stuff" got nailed. All of the market leaders sold off. Big cap tech (AAPL, RIMM, GOOG, MSFT), energy (CAM, DVN, DO), commodities (POT, MON, BG, PCU), heavy equipment (MTW, TEX, DE), and industrials (PH, SPW, PCP) were big losers. That is usually a sign that we are near a capitulation level.

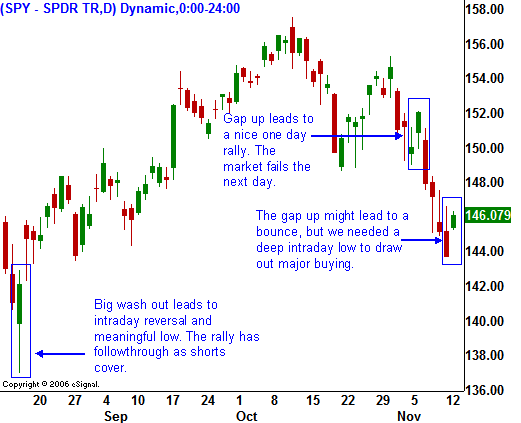

I don't trust rallies where the market gaps up after a big decline. Usually, those moves tend to stall and the market retests the relative low. Often times that retest will fail and the market will ultimately establish a new relative low. If you look at the chart, you can see the capitulation day in August. The market experienced a number of steep declines and it appeared that the world was coming unglued. The S&P 500 futures were down 50 points intraday and in the last 45 minutes, the market staged a huge reversal as buyers aggressively stepped in.

That low set us up for a meaningful rally to new highs. I would feel much better today if the market had tested the lows early on a big decline and reversed direction.

There is a take away from today's action. As I have been mentioning the last few days, the financials look like they have found support. Friday and Monday, the market traded lower yet financials held firm. If these stocks have temporarily bottomed out, this sector could help revive the market as it recovers. Financial stocks comprise 20% of the S&P 500 and they are largely responsible for the market’s current weakness.

Tomorrow we will get the PPI and retail sales numbers. I am expecting the PPI to come in "hot". Last week we saw a spike in import prices. A weak dollar is inflationary and that will make the Fed's job much tougher. They can't lower interest rates in and inflationary environment no matter how weak the economy looks. This soft patch will have to work its way through without any further rate cuts. Consequently, I believe the market will have a negative reaction to the news and today's rally will not get the follow through it needs. The retail sales number might actually lend a bit of support since a worst-case scenario is already priced in. Today's bounce is largely due to better than expected results from Wal-Mart.

Major technical damage has been done to the market. Early rallies have been followed by late sell offs. That is a very bearish pattern. For today, I believe that the rally will continue and there is a chance for a short squeeze near the bell. I still feel that we have not found the low, but we are close. I am seeing many good values in the market and I'm anxious to put some money to work. If the market strings a few good days together and if it can stay above SPY 146, it might be safe to put on a few long positions. Use SPY 146 as your guide for now. If we are below it, go to cash. If we are above it, take small long positions. If we go above SPY 149, add to your longs.

Daily Bulletin Continues...