Thursday’s Stock Option Trading Strategy!

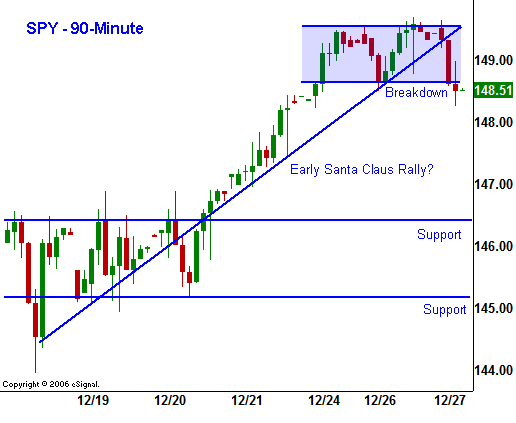

As you can see in the chart, prices have been trending higher for the last few days. No doubt, this is due to year-end strength. Technically, the Santa Claus rally should not have started until last Friday. I feel that traders may have jumped the gun.

Today, the market is trading lower on terrorism and economic news. A former Pakistani Prime Minister and opposition leader was assassinated today. Political uncertainty is elevated just weeks ahead of an election and the market is nervous. Mind you, Pakistan has nuclear weapons and they are the gateway for our war efforts in Afghanistan.

Excluding transportation orders, durable goods orders fell by .7% in November. Economists had expected durable goods orders to climb 2.9%. Initial jobless claims also rose to the highest level in more than two years. This news created selling pressure and as I've been mentioning, bad news is finally - bad news.

The bulls can no longer expect the Fed to rush to the rescue with another rate cut every time weak economic data presents itself. Inflation is on the rise and the Fed is handcuffed.

This is light holiday trading and you can expect choppy price action. Asset Managers are window dressing for the end of the year. Stocks have performed well will continue to do so. As you can see in the chart the last two days have yielded a tight trading range. We have currently broken below that support and given the negative backdrop today, I expect the market to drift lower this afternoon. Expect very light volume tomorrow and Monday.

Towards the end of next week, the market will come to life. There will be earnings releases and the Unemployment Report. I believe the next Unemployment Report could provide significant selling pressure.

Keep your powder dry.

Daily Bulletin Continues...