Thursday’s Stock Option Trading Strategy!

Option trading is based predictability and buying stock options before a big number is a crap shoot. Weigh the news, wait for the reaction and then make your move. You might miss some of the gains, but you won't have your head handed to you if you are on the wrong side. You will also view the action with a clear perspective.

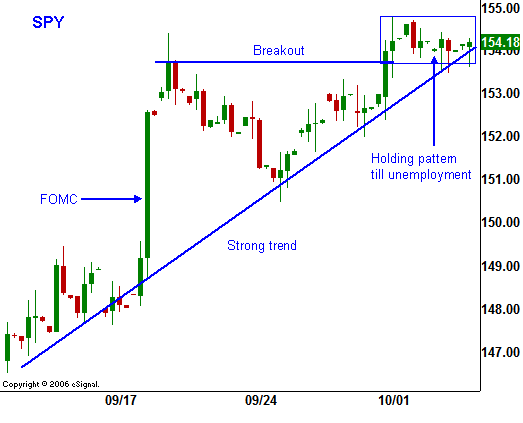

In the last three days the market has been treading water as it tries to hang on to Monday's gains. The daily ranges are compressed as traders wait for tomorrow's Unemployment Report.

I believe that a solid number that only shows a slight increase in unemployment will result in a rally. The market will benefit from the best of both worlds - lower interest rates and moderate economic growth. This will not put the Fed in the best light since it would indicate that they hit the panic button.

If the number shows a substantial increase in unemployment, the market will have an initial negative reaction. Once the dust settles next week, traders will expect another rate cut and the market is likely to rally on that notion. This is exactly what happened last month.

Many traders state that once a half point interest-rate reduction has taken place, the Fed historically continues to ease.

This "easy money" policy bothers me. In the last five years the dollar has fallen over 30% against most major currencies. Our purchasing power is shrinking and most Americans don't even realize it. We spend more than we make and the world is flush with US dollars. Our heavy debt load makes our currency a poor investment and our two biggest investors (China and Saudi Arabia) are diversifying out of the US dollars.

Corporate profits are still rising at a nice pace and even the brokerage firms that were supposedly in dire straits posted good numbers. Home prices were up 25% on average from 2001 through 2006. Now that some of those phantom gains have been pared back, home owners are screaming bloody murder.

Of the homeowners that are defaulting, 25% are speculators who own multiple properties. When all of us lose money on a trade it would be nice to have the government step in and bail us out.

I thought I would vent my frustrations on a quiet day when there is not much else to write about. I expect the market to move higher, it's just a matter of when. I plan to go into the number flat. I will position myself once the dust settles. There are many weak stocks that have recently bounced. Department stores, home builders and automotive are a few examples. Once the short covering bounce fails, they’ll be ripe for another round of selling.

Next week, Alcoa announces earnings and that will kick off the new quarter. There aren't many big earnings releases slated for next week. Keep your powder dry.

Daily Bulletin Continues...